The US dollar is facing a change in the tide of rate expectations, much like the pound is. The market trying to trade exact periods of time whether it’s Q1, Q2 or Q3 2015 that they come. Hanging on the shirt tails of those expectations are us retail mob trying to make a buck in between.

There’s plenty of valid arguments on this site for when, how, why and whether rates will rise and that makes for a lot of different opinions and directional choice. Whatever your own personal view is it’s the view of the overall market that we need to listen to. For all the guessing games on when rates are going up there is no discussion that they’re not. The market believes rate rises are coming and they are going to continue to trade that way until told otherwise. However, the Fed have started a campaign on jawboning the dollar and it’s effect on the economy. We noticed it when Dudley became the first to mention it and it’s spread to other members too. (See Fischer and Evans)

So we’ve got a little bit of a fight on our hands. The rate mob and the the Fed mob are on each side of the trade. One wants to know when rates are going up and the other are listening to a still dovish Fed. The rate crowd are going to win and the Fed mob are going to be the ones to change their ways come 2015. Rates are going up, every central bank has said so. While the timing is undecided the fact is they are.

Into 2015 the bias for the dollar is stil up and therefore it’s the long side that I’m going to be trading from longer term. I feel that the dollar has one more big run in it sometime in 2015, when rate rises dates get narrowed down, but then we’ll start to settle down to trading a normal fundamental market.

The Fed has been happy to let the dollar run up as a favour to the Japanese as they need a strong Japan just as much for the US economy as the Japanese need for theirs, but there will be a limit and that may be edging nearer.

Looking long term I can see a range somewhere between 100-120 as being a healthy number for both the US and Japan, at least over the next couple of years. I’m not usually one for picking numbers too far ahead but it would take something big to have us running to 150+ or down through 90.

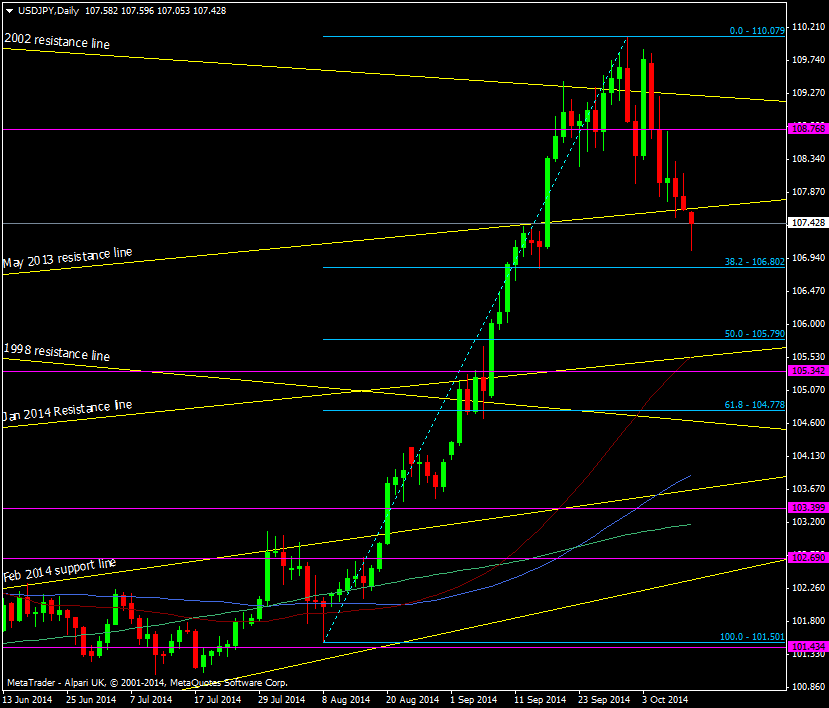

In the here and now we continue to retrace the break of 103/104 but still haven’t made the 38.2 of the break at 106.80. I’m liking the tech around the 105/106 area should we see the selling continue and while the rate story is still undecided, and the Fed go waffling on, we have plenty of reasons why we might go down there.

USD/JPY Daily chart 13 10 2014

Nearby the 107.80/90 level is the one to break but we’re finding resistance before that at 107.60. Support is coming in ahead of 107.00 and as we slide from the session high 107.20/25 is likely to be mild support too.

There’s always plenty of scope to trade both ways and on different time frames. What I’m saying here doesn’t equate to what might happen in the next 5 minutes. I like to have a grasp of the bigger picture as it helps me keep on the right side of a trend for the longer term.