The one constant in the UK economy has been the strong labour market. Whatever you say about the strengths and weaknesses of an economy the jobs market is always the mainstay.

Today we’ll see whether the H2 slowdown in the UK economy is going to start affecting the work force. There’s been enough confidence in the UK for businesses to hire and so we’re unlikely to see the numbers go backwards. This current sentiment of growth and inflation worries has only really come to a head over the last week or so, so this report is unlikely to feature any of those worries amongst businesses.

Like any trend though the data doesn’t move in one direction forever, so at worst we’re likely to see the jobs outlook go sideways rather than backwards.

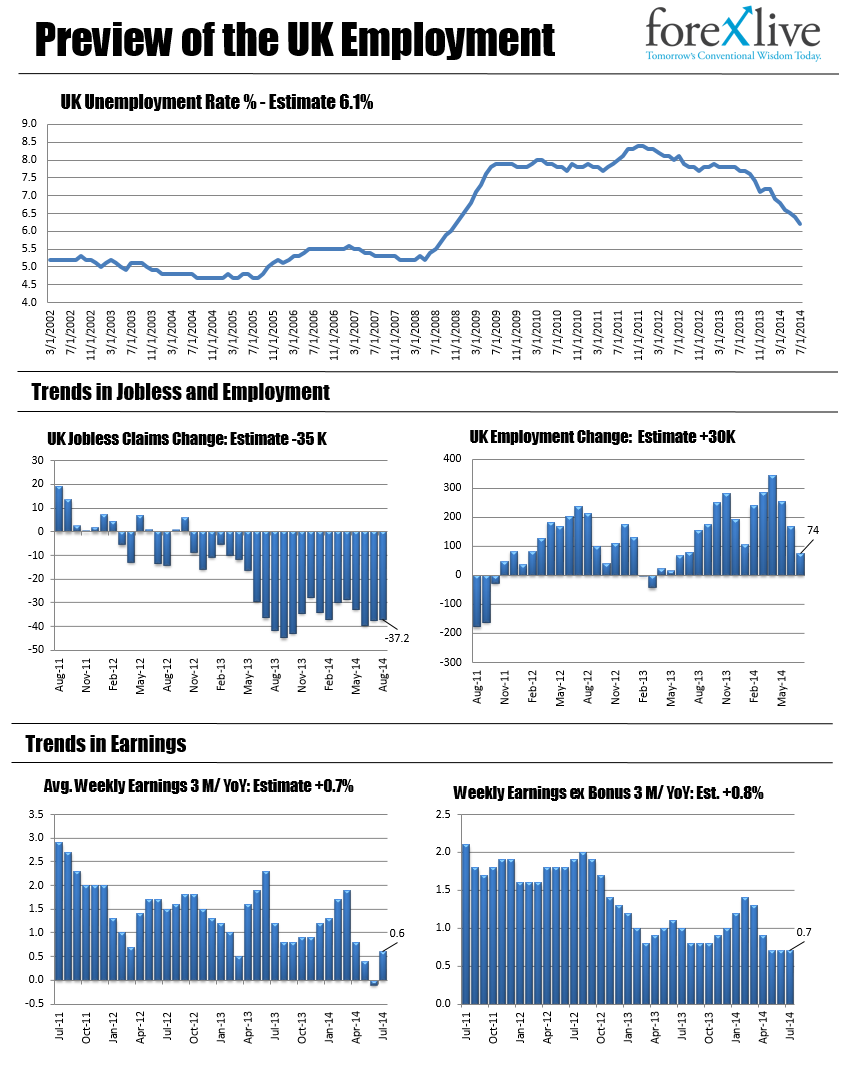

The claimant count (number of people claiming unemployment benefit) is expected to fall by 35K following a fall of 37.2k in August. You have to go back to October 2012 to see the last time the claimant count rose.

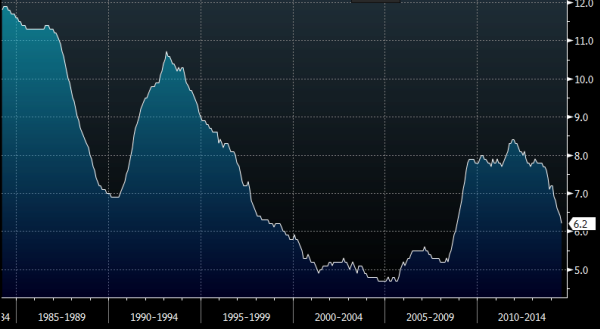

The unemployment rate has been falling steadily since 2011 but we’re still a ways off the early 2000 boom years (tongue firmly in cheek). It’s expected to drop tomorrow to 6.1% from 6.2%

UK ILO unemployment rate to July 2014

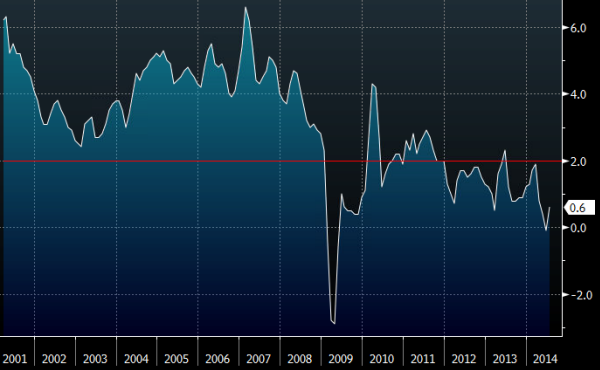

As usual it won’t be so much about the employment numbers but about the inflation aspect from wages.

Much was made in the UK press when wages passed inflation. The fact of the matter was that it was inflation that passed wages on the way down. Even since then wages have weakened when they really should have been rising. That’s down to where we are in the jobs cycle.

The employment cycle has three main stages;

- Can’t get a job

- Get any job

- Change jobs to the one you really want

The UK is still in stage two in this recovery. It’s still very much an employers market so until that balance changes wages are likely to remain weak. With the UK inflation target at 2% you can see what needs to be done to get wages up and over that level (assuming we get back to 2%).

UK average weekly earnings 3 month rolling y/y to July 2014

Wages are expected to tick up to 0.7% vs 0.6% (ex-bonuses to 0.8% from 0.7%). If we hit 1.0% tomorrow then the pound might get a short term run up, which given the current sentiment in the market will likely be sold into pretty hard.In fact, any good news pop is likely to be waded into by sellers right now.

On the other side, don’t discount that even the mildest bit of bad news won’t hit the pound hard as the sellers will be looking for any excuse to hit the quid. The labour market is still strong and it will take some shaking out to weaken it. Use the report to to get into better levels or to take some off the table, whichever way your siding.

September 2014 UK labour market report preview