We had a little dip through the big figure overnight but it was fleeting and we’re back holding above now.

The jobs report was “meh” and although the drop in claims wasn’t as much as expected it is still going the right way. Jobs growth is jobs growth any way you look at it. I said in my preview that at worst it will start to go sideways and that’s just about what today’s numbers reflect.

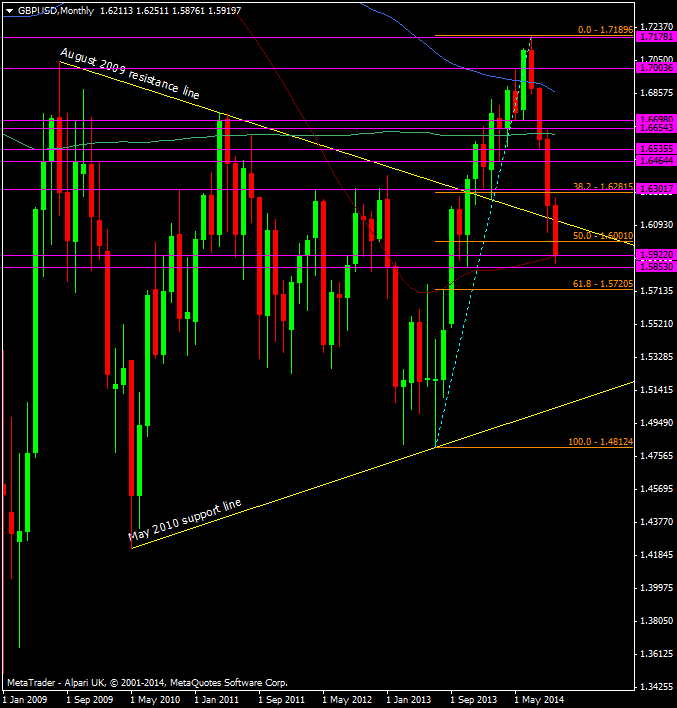

That it wasn’t worse may be some comfort to the buyers down here and they’re keeping the pound afloat. A proper break of 1.59 and we’re likely to see the quid tumble further towards the 61.8 fib of the 2013/14 lo/hi at 1.5720. The Nov 2013 low at 1.5850 stands in the way of that and it’s another level that has been a historic S&R area.

GBP/USD Monthly chart 15 10 2014

We’re also pivoting around the 55 mma and that’s a battle in itself.

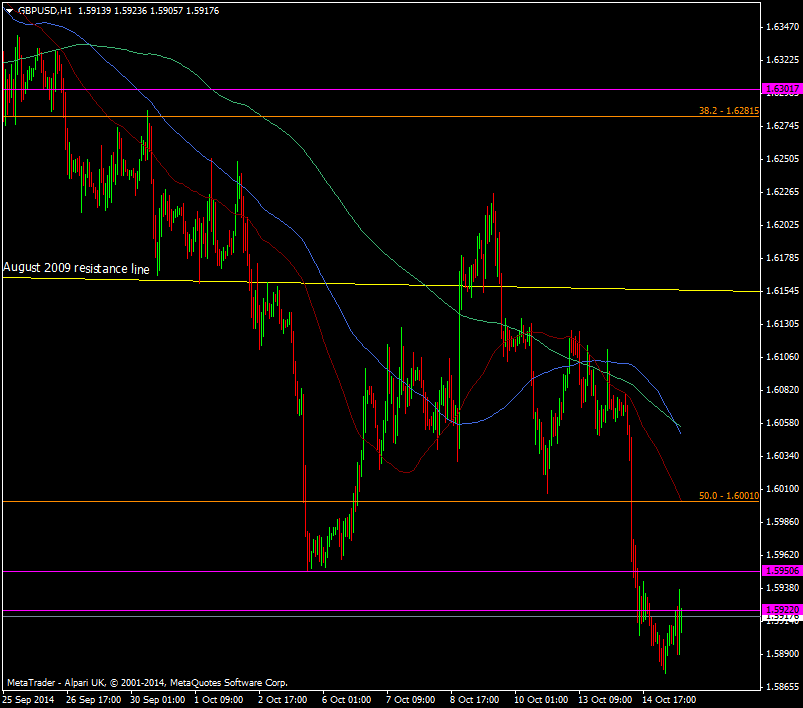

Zooming in a bit closer, 1.5940 and then 1.5950 are the near levels we need to overcome. 1.5950 is the stronger of the two. Overcome those and we can think about having a look at 1.60, which again is a juicy level containing the 200 wma and old 50.0 fib. On the way up look for minor resistance at 1.5980 too.

GBP/USD H1 chart 15 10 2014

I’m starting to get an itchy buy finger now but I’m a bit cautious over everything that’s going on. I’m concerned that this slowdown is going to last into 2015 and that it’s going to be driven by the weakness in Europe. I said right at the start of the year that our recovery has been domestically driven and that we would need to see Europe improve to bolster our exports. It’s not happening and that is what is going to put the breaks on the recovery.

On the positive side I still don’t see our economy going backwards as there is support for it domestically, and that’s not going to disappear anytime soon. People are still getting jobs meaning people will be spending. The chances are that the economy will go sideways rather than backwards and that’s probably going to be as good as it gets until Europe sorts themselves out.

Lastly, rate rises are still coming unless things really crater. Central banks are desperate to raise them and that rhetoric is going to win out. Remember the mantra, “you don’t fight a central bank”