I want to move like stocks. I want to move like stocks. I want to moooooooooooove, like stocks do….

The stock market started to rebound and so did the price of the EURJPY.

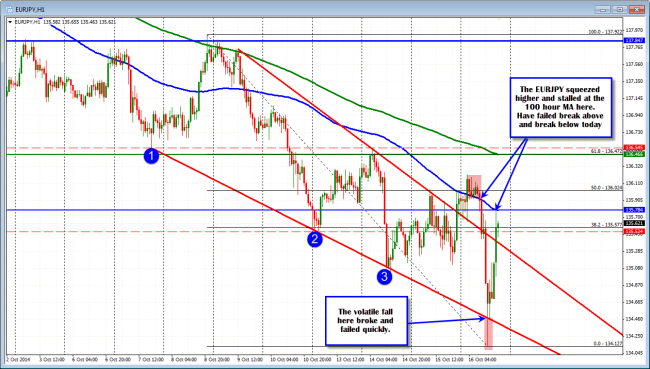

The pair has been somewhat attached to the ups and downs in equities today. There has been a failed break above the 100 hour MA (blue line) in the Asian session and just before NY traders entered for the day, there was a break below the bottom side trend line. That move quickly failed.

The last push higher stalled at the 100 hour MA. It seems to be a level to eye. A level to get and stay above now if the buyers are to start to take back more control.

When a currency pair starts to be so tied to another market, technicals can get distorted as focus ironically moves to trading the EURJPY off of the S&P chart (why not just go trade the S&P?). However, as the chart below shows, failures can give bias change clues as well (it might be a better trade strategy in these choppy markets). Sometimes the levels also hold – like we are seeing now in the EURJPY.

Risk (market, event and liquidity) risk may not be as high as yesterday, but it still is in the market so be more cautious – traders are driving in a snow storm still (see video from yesterday for what I mean).

On a break above (i.e. a continued push higher in the stock market), the 136.02 is the next target. For those interested in selling, the broken trend line at 135.39 held the correction so far. So getting below this level will be eyed.

EURJPY following the stocks