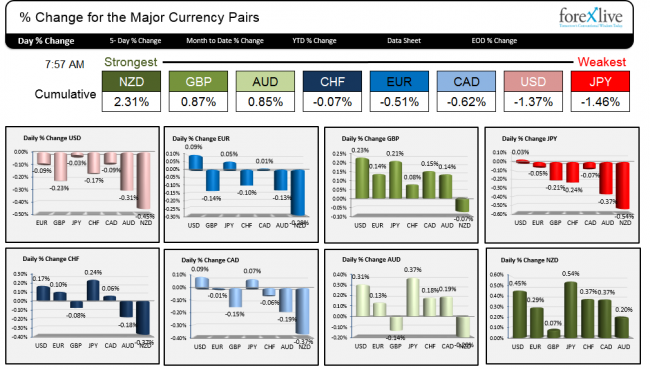

The strongest currency is the NZD and GBP. The weakest is the JPY, although the JPY has reversed off the lows on the back of weaker stocks in Europe, and an expected fall in US stocks on the back of SAP lowering earnings estimates, and IBM reporting much lower earnings (down -15 in pre-market trading for Big Blue). The USD is also lower in trading today.

A snapshot of the strongest and weakest currencies as NY traders enter for the day.

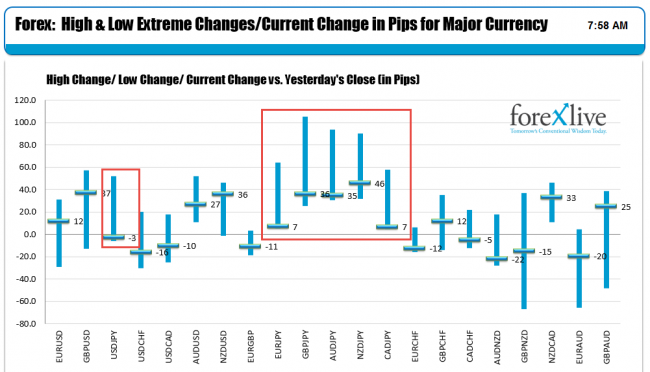

The below chart shows the changes from Friday (High change, low change and the current change). Note the reversal of the most of the JPY pairs from their peaks.

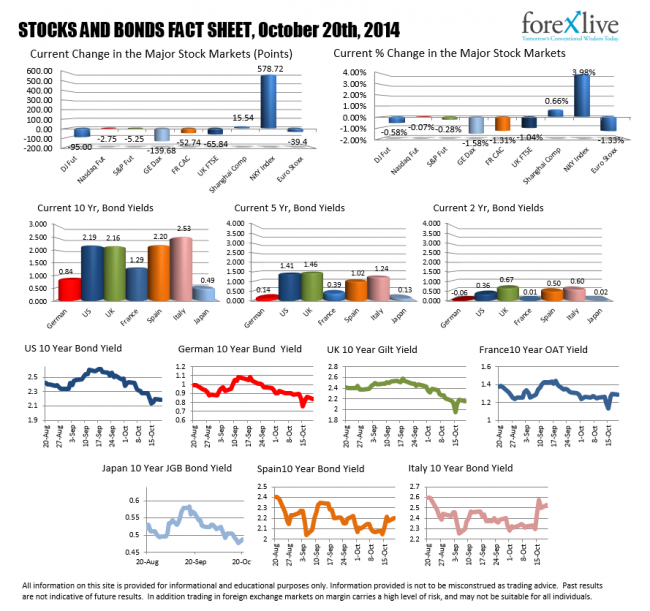

All JPY currency pairs initially rose on the back of weekend news that the Japan pension fund would invest up to 25% in stocks. As a result, the Nikkei surged 3.98% (see chart below). Since then, however, global stocks have not had such a strong reaction. The SAP news “sapped” the strength out of the European stock indices (all showing declines) and the US stock in pre-market trading are feeling the effects of the IBM miss (see snapshot of stocks and bonds below).

The US 10 year bond yield plunged to below 2% last week at the height of the fear from Ebola and weak US economic data (i.e. Retail Sales, Empire Manufacturing and PPI). That was reversed as Ebola fears subsided and better economic data for the rest of the week – led by lower Initial Claims and Industrial Production – helped reverse the flow of funds into the safety of the US debt.

There are no economic releases scheduled in the US. Canada will release Wholesales Sales and Inventories at 8:30 AM ET with expectations of -0.3% MoM decline (last month -0.3%). The Bank of Canada is expected to keep rates unchanged when they announce on Wednesday at 10 AM ET. .

Stocks and Bonds snapshot