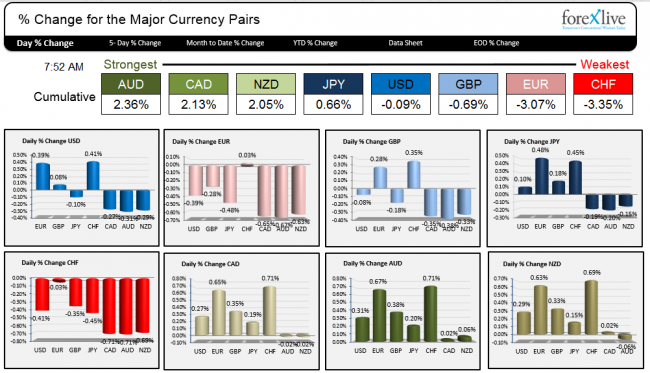

As New York traders enter for the trading day, the forex market is showing that the Australian dollar (AUD) and the New Zealand dollar (NZD) are the strongest currencies. China posted a slightly stronger GDP of 7.3% vs 7.2%. This sent both currencies higher as their economies rely on exports to China for economic growth.

The weakest currencies are the Swiss franc (CHF) and the euro (EUR). The EUR is under pressure on a Reuters report that the ECB is looking to purchase corporate bonds as a way to add liquidity to the market. The ECB denied the report but the markets focus was reminded of the relative weakness of the EUR. In Switzerland, their trade balance came in with a surplus of 2.45 billion. However, both exports (-3.3%) and imports (-7.4%) fell. The CHF is tied to the EUR’s fortune as the SNB continues to pledge that the EURCHF will not go below the 1.2000 level. As a result, if the EURO is under pressure, so too should the CHF.

Forex: The strongest and weakest currencies as NY traders enter for the trading day.

The US dollar is mixed at the New York opening. It is stronger against the EUR and CHF, little changed against the GBP, but down against the JPY, CAD, AUD and NZD.

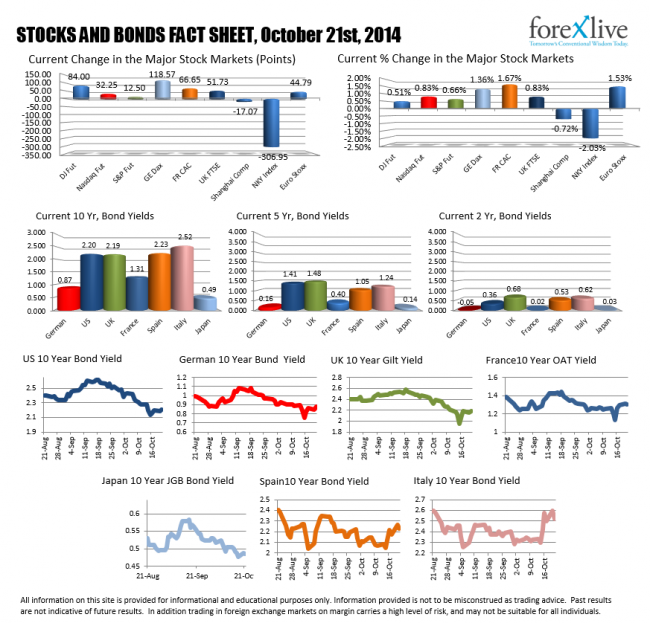

Stocks and Bonds

Stocks are higher in Europe and in pre-market US trading.

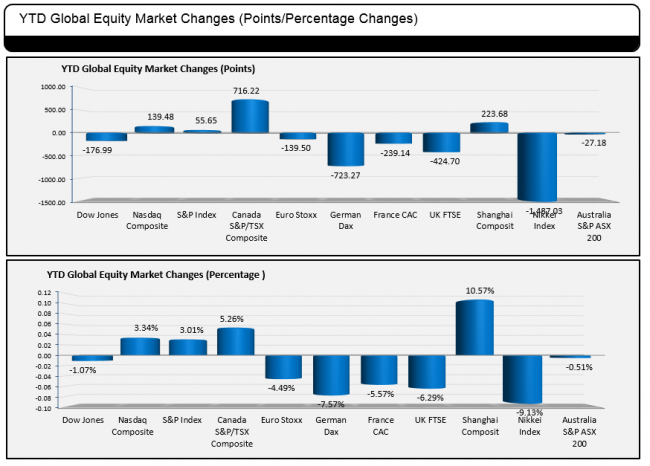

The European stock markets are showing gains this morning (German Dax up 1.36%, Euro Stoxx up 1.53%, UK FTSE up 0.83%) on the additional stimulus idea (more liquidity pushes up stocks). The European stock indices – with the exception of the Spanish Ibex (+1.79% for the year) are showing declines, with the German Dax performing the worst at down 7.57% (see chart below). This is not helping matters in the EU.

The YTD change in global stock markets.

In the US pre-market, stocks are also expected to rise (S&P futures up 0.66%, Nasdaq futures up 0.83%) after Apple earnings -reported after the close last night – were better than expectations.

The bond markets are steady. The 10-year US treasury is at 2.20% vs 2.19% yesterday. German bunds are trading at 0.88% also little changed from yesterday’s levels. Spain and Italian bonds are dipping lower a bit after the sharp run up in last week’s trading.