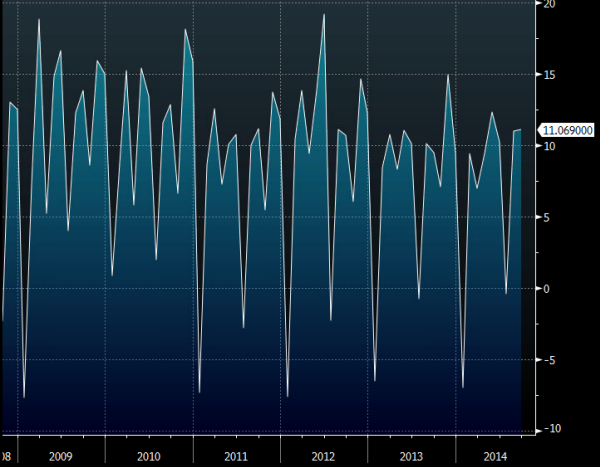

- Prior 10.883bn. Revised to 11.0bn

- Ex financials/banks 11.83bn vs 10.5bn exp m/m. Prior 11.6bn. Revised to 11.7bn

- PSNCR 17.7bn vs 1.583bn prior m/m. Revised to 1.939bn

- Central government NCR 21.7bn vs 3.1bn prior

- PSND ex-banks 1.4513tn or 79.9% of GDP, matches highest on record

Over the last 6 months government borrowing is up over 10% on last year. The borrowing numbers shoot to bits the coalitions plans to eliminate the deficit by 2015. The government blame the extra borrowing on “an uneven pattern in tax receipts in 2013″. Last week the head of the budget watchdog said that there was a big problem with low tax receipts being seen despite the increase in employment. Income tax revenue was 2.3% higher than a year ago.

Higher borrowing isn’t a shock to many and I don’t think an army of accountants could unravel the underlying numbers between the ONS reworking the calculations from last month and the governments crap about patterns in tax receipts. The long and short is that borrowing is up, the government is a million miles away from fixing it and no one really has a clue what is going on. Watch these numbers start to become even more of a political stick with the upcoming elections next year.

Cable sits at 1.6160

UK PSNB 21 10 2014