The GBPUSD is off today on the back of the Bank of England (BOE) Monetary Policy Committee meeting minutes which showed most policy makers see risks of a slowdown as a result of the Euro areas economic weakness. This raises the speculation that the BOE will remain on hold for a longer period of time. Hence the decline in the GBPUSD in trading today. The vote remained at 7-2 with seven members opting to keep the rate steady at 0.25% and two still wanting to raise rates (this is nothing new).

GBPUSD is back down below 100 hour MA and trading around the 200 hour MA.

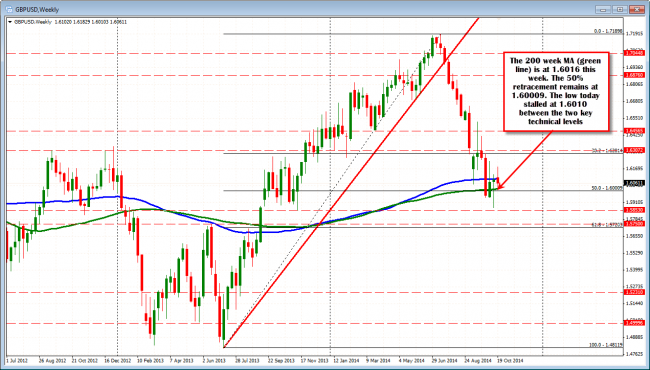

From a technical perspective, the price moved below both the 100 and 200 hour MAs (at 1.6103 and 1.6056 respectively) and moved to a low price of 1.6010. The 200 week moving average is at 1.6016 this week. The 50% of the move up from the 2013 low to the 2014 high is at 1.60009. This key technical level has stopped the selling.

Although the price of the GBPUSD has traded above and below the 200 week MA for 4 straight weeks (we are within 10 pips of doing the same for the 50% retracement), the level still is an important technical level. The market is simply not sure of the directional move to make just yet.

GBPUSD on the weekly chart came down and tested the 50% and the 200 week MA at the 1.60009-1.6016 area and bounced.

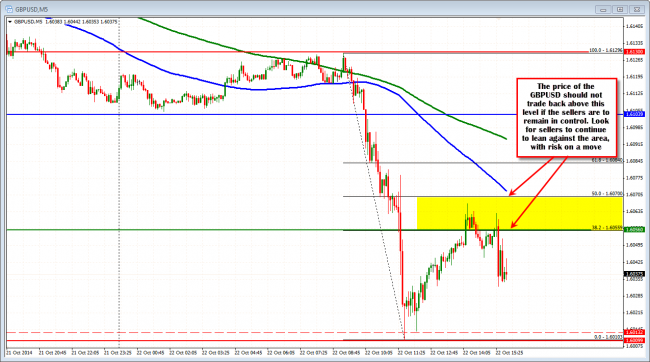

Yesterday, I was looking for the GBPUSD to find support against the 1.6121 level. That level split the most recent low trading range from a higher level. That line failed to hold and the bias turned back to the negative.

What do you do now?

Obviously, the price momentum is trending back to the downside. The trading range is about 122 pips. The average is 127 pips over the last month of trading. The correction off the lows has taken the price to the 38.2-50% of the move down – staying below the 50% will be key for trading today. Trend moves – tend to keep below this area on corrections. The 50% comes in at the 1.6070 level now Traders who are short, can use this level for risk. Patient sellers can see if there is another bounce toward the 1.6055 level to lean against with the risk above 1.6070.

Needless to say, the reward will only come if the price moves below the 1.6000 level (and then stay below). Since the range is fairly decent today and the price stopped at that key level, it may be a difficult task to get below that level. So be aware of that the pair may ping pong between levels for the time being.

GBPUSD should stay below the 1.6070 level if the sellers are to remain in control (RISK). Look for early sellers ag. the 1.6055 area now.