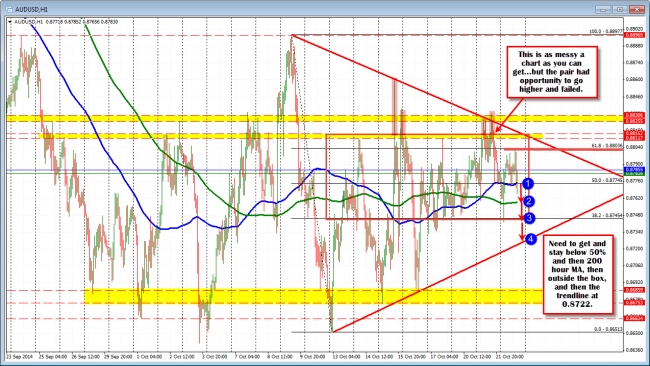

The AUDUSD hourly chart is about the most messy thing I have seen in a while (see chart below). Yesterday, I thought the pair had the chance to break on the back of the China releases. The price indeed moved higher, extended above the topside of the high “value” area where most activity has taken place (see red box) and even the topside trend line, but that move FAILED. That has me thinking the longs had their shot. They had better China GDP (well by 0.1%). They had the BREAK. But they could not sustain the momentum.

AUDUSD is a mess.

Admittedly, the move lower today found support against lows from Friday/Monday (predictable) and the price is back above the 200 hour MA (green line), the 100 hour MA and 50% as the price continues to chop around. This is actually bullish technically but I don’t trust the longs. They had their shot. I still respect them but I don’t trust it.

However, if this last push higher fails and moves back below the 100 hour MA/50% at the 0.8774 area, look for selling to intensify. The steps would then look to take out the 200 hour MA at the 0.8758, the low for the day at the 0.8743 area, and then the lower trend line at 0.8723 area.