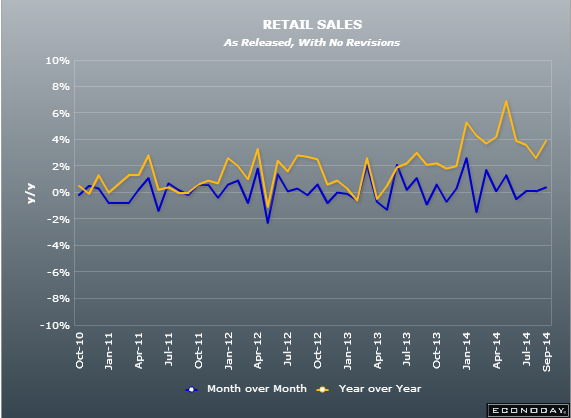

September retail sales are expected to fall from 3.9% to 2.9% y/y (Ex-fuel 4.5% to 3.4%) and post a 0.1% drop from +0.4% gain in August m/m. That’s a hefty fall and going by the minor data points already out looks more than justified.

August 2014 UK retail sales

Last week the British Retail Consortium’s like for like retail data showed a big drop falling -2.1% vs +1.0% exp y/y. In August it was up 1.3%. Excluding easter distortions it was the lowest number since December 2008. Clothes were the biggest driver and they had their worst performance since April 2012. The only plus side was big ticket items like furniture continued to show strength. Even so, that’s a big big turnaround in yearly numbers, even for a volatile data point like this.

Furniture still seeing strong sales and with falling fuel costs the possibilities are endless

Putting another tick in the “oh oh, this could be trouble” column, the Lloyds consumer confidence index fell for only the second time in 2014. Not only did confidence drop but sentiment for the current economic situation fell too. Confidence was down 6 points to 146 and sentiment fell 15 to 275.

Overall spending on essentials fell 0.5% from last year led by price wars among supermarkets and there has been no growth in food and drink spending in the last three months. Spending on fuel and utilities was down 6% & 5% y/y respectively. The caveat to these numbers is that prices have dropped which has meant that the actual £ spend has been lowered. The key will be if households transferred the extra savings to other purchases of non-essentials.

In amongst all this consumer doom and gloom come a small ray of sunshine from the Markit household finance index which rose to 42.6 from a revised 42.3 (below 50 marks pessimism. Not a big jump but it takes the index to the highest since Feb 2009. Markit also note that pay growth remained strong in September rising the fastest since July 2013. The news wasn’t so good looking forward 12 months as the measure for financial well being fell to 47.5 from 48.7. Savings and available cash continued to fall but not as fast as it had been.

So where does that leave us?

The BRC numbers should give us the biggest cause for concern over tomorrows numbers. Yes there were gains in bigger ticket items but even they couldn’t stop the large fall. Really, the only thing going for retail sales is the prospect that utilities and fuel prices may be going down. Once again it might not be seen in these numbers as much as next month but it will put extra pounds in people’s pockets. On the plus side, from my wanderings around town, restaurants and shops have been quite busy and my cabbie mate says September was a very good month in the city, particularly nightclubs.

The ultimate nightclub accessory

Trading wise I think I think the downside is covered with expectations but be prepared for a worse number. Even if we get a fantastic number it’s not going to turn everyone pound bullish and it’s certainly not going to change the rhetoric from the Bank of England. Retail sales is one of those figures that can surprise either way and is one of the best data points to fade if it goes against the underlying trend. There may be value in a small tight GBP short before the number (depending on how it’s moved beforehand) and the bigger opportunity might be to sell into any upside surprise.