Forex news for October 23, 2014:

- Doctor who treated ebola patients rushed to New York City hospital

- US initial jobless claims 283k vs 282k exp

- October 2014 US Markit manufacturing PMI flash 56.2 vs 57.0 exp

- August 2014 US FHFA house price index 0.5% vs 0.3% exp m/m

- Bank of Japan sees greater risk of inflation falling below 1% – WSJ

- October 2014 eurozone consumer confidence (or lack of) flash -11.1 vs -12 exp

- September 2014 US leading indicators 0.8% vs 0.6% exp m/m

- Bank of Italy primed for lower Q3 GDP

- Saudi Arabia cut oil supply in September

- October 2014 KC Fed manufacturing index 3 vs 12 prior

- Gold down $9 to $1232

- WTI crude up $1.51 to $82.03

- S&P 500 up 25 points to 1952

- US 10 year yields up 5.8 bps to 2.27%

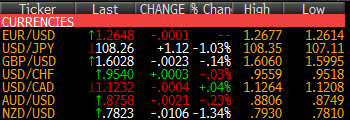

- CAD leads, NZD lags on the day

The euro got a lift from better PMIs in European trading but wasn’t able to continue to the upside. The top for the pair was 1.2677 just as US traders began arriving at their desks and it was a sideways/lower chop from there. Last at 1.2650 which is about right in the middle of the US range.

The action was in the yen crosses as better risk appetite and a report that the BOJ is giving up on its inflation targets that sent the yen spiraling. USD/JPY broke above the session high of 107.63 on the headlines and then continued all the way to 108.35 before ebola in NY fears sent it back down to 108.05. It’s in a delicate spot at the moment as the market weighs whether or not it cares about ebola.

Cable was in a 50-pip range from 1.6000 to 1.6050 and finishes right in the middle of it.

The volatility in USD/CAD wasn’t anywhere near the levels of yesterday although it took a quick dip down to 1.1208 before bouncing right back to 1.1240 early in US trading. It wasn’t able to get up to the 1.1260 levels from Asia-Pac trading and was generally tracking lower late in the day on better risk appetite.

Yet AUD and NZD continue to show no signs of bouncing on better vibes in stock markets. The kiwi was smashed by the CPI report yesterday and finishes near the lows of the day at 0.7822. The Aussie tried the upside in early US trading, touching 0.8806 but then sagged back to 0.8757 later, just above the Asian lows.

Gold took a hit down to $1225 as dissipating global fears and the end of Diwali sparked some selling but it bounced later on ebola buying.

Crude liked the Saudi headlines and that protected $80 in WTI and might be a very early sign of a bottom in crude.

daily changes