Nomura highlights six specific pieces of negative news, which all point to further downside for EURUSD in the final months of 2014:

1) Fixed Income Portfolio Flows are Weakening.

2) M&A pipeline shifting to Euro negative Corporate FX flow, linked to M&A, has shifted to a clearly negative direction for the Euro.

3) Risk aversion and portfolio rebalancing failed to support the Euro substantially early in Q4.

4) The ECB is considering further balance sheet expansion.

5) Economic data have weakened substantially.

6) Financial stability risks highlighted again Eurozone peripheral spreads widened notably last week.

More:

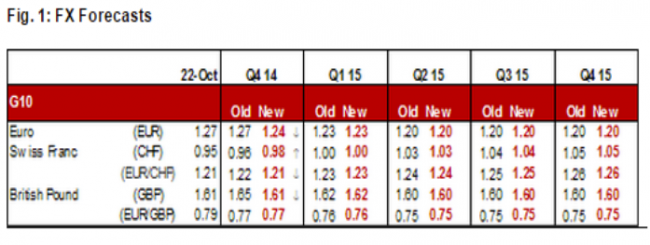

- Nomura cuts again its Q4 target for EUR/USD from 1.27 to 1.24. For 2015, Nomura forecast are unchanged continuing to target 1.20 by Q2 2015.

- “All told, we are revising our Q4 target for EURUSD to 1.24 from 1.27. In addition, we are tweaking EURCHF down to 1.21 from 1.22 for year-end 2014,” Nomura projects.