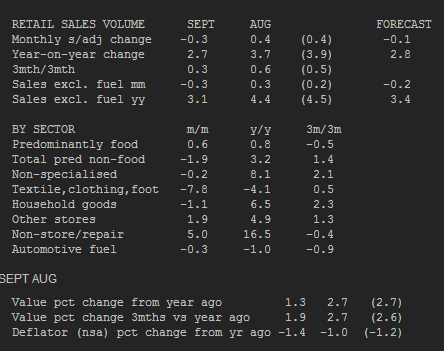

- Prior +0.4%.

- 2.7% vs 2.9% exp y/y. Prior 3.9%. Revised to 3.7%

- Ex-autos -0.3% vs -0.2% exp m/m. Prior +0.2%. Revised to +0.3%

- 3.1% vs 3.4% exp y/y. Prior 4.5%. Revised to 4.4%

Cable smacked down to 1.5999 on the worse numbers.

Weakest sales since Jan. Big fall in clothing and footwear -7.8% m/m. Biggest fall since April 2012. We had the heads up from the BRC report detailed in my preview and the clothing fall shouldn’t have been unexpected.

UK retail sales details 23 10 2014

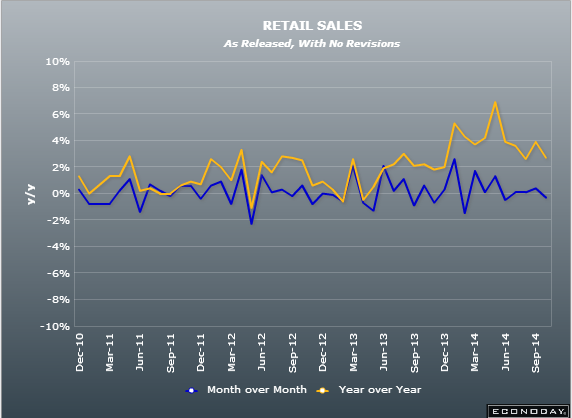

Retail sales continue to slide from the early years highs and it could be a sign that people have had a blow out spending spree and we’ll be back at seeing modest to low sales growth going forward. The spring/summer months were bumper for big ticket items but they are one off’s on a large scale.

October will be interesting as we may see a jump heading into the Christmas season if utilities and fuel prices drop along side the energy prices. That little bit extra may go through the tills elsewhere.

UK retail sales 23 10 2014