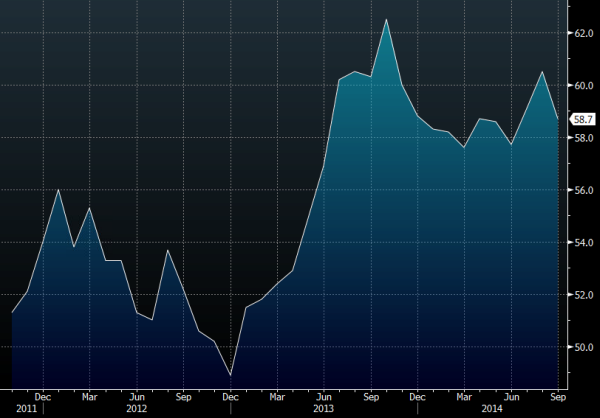

Let’s start at the top with UK services. Over Q3 we had another jump higher in the Markit PMI which tailed off into the end of Q3. Despite that we still remain above Q2 levels, just.

UK Services PMI 03 10 2014

Services are the biggest part of the UK economy so this should be the main focus. Looking again at the PMI, New orders finished on a high and employment in the sector continues to grow. Looking deeper down we hit some problems. We saw today’s retail sales plummet and this could be a big drag on GDP.

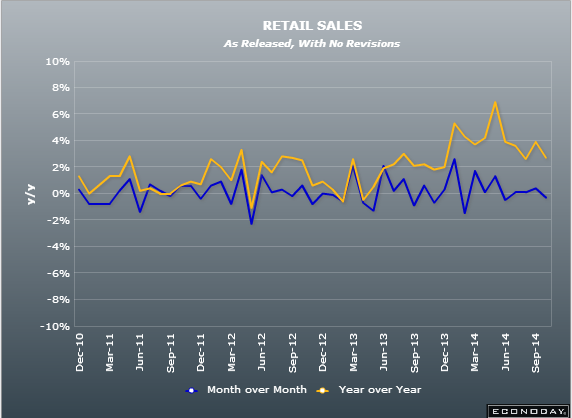

UK retail sales 23 10 2014

Year on year it’s followed a similar pattern to the PMI data above and over the 3m/3m only dropped to 0.3% from 0.6%. There’s no getting around it though, the numbers stank this morning and not even a late burst of good weather could boost sales.

An extra couple of weeks of good summer weather like this couldn’t save retail sales.

The other sectors are also joining in the slump. Construction particularly has had a very strong run up since last year and we’re seeing some of that fading now. Manufacturing looked to be making a fist of things but the air has come out of that too. On the trade side the deficit narrowed for the first time in 5 months in August but both exports and imports fell. Q2 exports were -0.4% while imports were down -0.3%. Government consumption jumped in Q2 to 1.0% from -0.3% in Q1 and if those gains are maintained then that’s another supporting factor for GDP. Household consumption has still been less than stellar and it’s hard to to see it picking up this quarter with only minor signs of wage growth. Gross fixed capital formations (acquisitions vs disposals of fixed assets) dropped in Q2 to 1.3% from a three quarter run of 2.4%-2.8%. GFCF is not a decisive or direct investment metric in itself but it can be used for a very broad sense of investment. A further fall is another negative for growth. What are we expecting from the numbers? The H2 slump has been factored into expectations and the market sees 0.7% q/q from 0.9% in Q2 and 3.0% vs 3.2% prior y/y. I would say that’s probably spot on, though like retail sales today, I still think we could see a drop more than expected. The long and short is that services was probably flat to small down across the third quarter while manufacturing and construction were worse than Q2. Trading wise, my usual 0.2 differential is in effect again but being GDP a 0.1 q/q move is going to be enough to see a decent reaction. If we beat expectations then the pound goes up but I feel any moves will be limited and unlikely to last. Sentiment may be changing about the US but it’s still on a negative bias over this side of the pond. A 0.2 beat and we may have enough to at least kick us to a new higher range within 1.61-1.62. The downside is going to be the main focus and dependant on where we are just before, 1.60 is likely to be toasted on any miss. 0.6% or less and we’ll be seeing 1.59 pretty fast and potentially worse if the buck remains bid. The rate race between the US and UK is still on and a poor GDP number will put the US firmly out in front and the dollar side of cable will be well in control.

Hopefully not the UK economy come 08.31 gmt