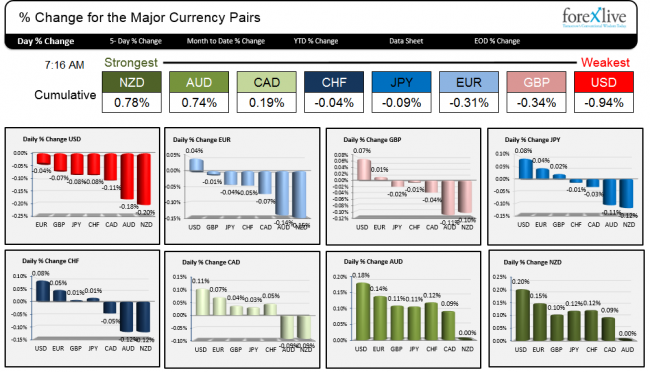

As New York traders enter for the day, they are faced with a very quite market. The % change of all the major currency pairs are close to the close from yesterday. The largest % change of any currency is 0.2% (the NZDUSD). As a point in comparison, yesterday, the largest changing currency pair moved 1.34% – also the NZDUSD. Even the UK GDP failed to ignite much of a reaction. Of course it came in as expected at 0.7% ; ( The EU Bank Stress tests will be released on Sunday. The talk is 11 banks will fail. That is not confirmed but was bantered about in the press on Wednesday.

The Forex Winners and Losers (a snap shot) in trading for October 24th, 2014)

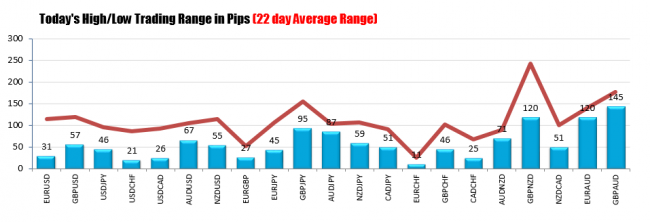

Not only are the changes minimal, but the ranges are also minimal. Looking at the current trading ranges, the high to low ranges are well bell the 22 day average. This is indicating a market that is non-trend like for the day. The AUDUSD tried to gets something started but stalled. It has the largest trading range of the major pairs against the USD.

The low to high trading ranges are well below the averages.

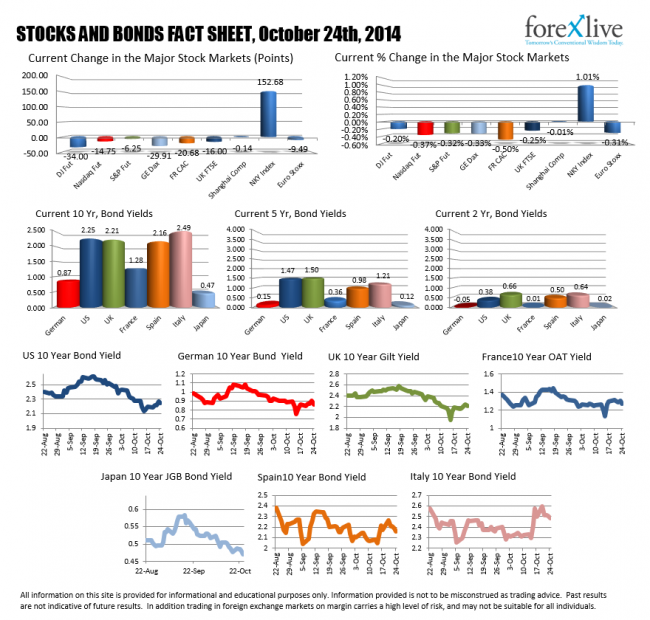

The Stock and Bond Markets

The stock markets are showing more weakness today after the sharp moves higher yesterday. The “Ebola in NY” headlines have put the brakes on some of the frothy-ness out of the market. The US 10 year bond yield moved up a touch from the same time yesterday (a basis point or 2), while the German Bund is down a basis point.

Stocks and Bonds. As snapshot.

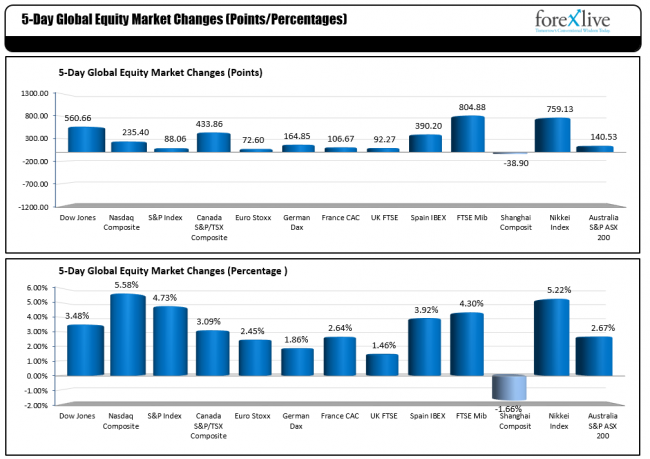

Stocks this week have showed nice gains over the last 5 trading days – especially in the US where a combination of earnings and a race to get back in after last weeks shift in allocation. The Nasdaq is up 5.58%. The S&P is up 4.73% and the Dow is up 3.48%. Not a bad gain.

The Stock Market gains over the last 5 trading days.

The Major Economic Releases

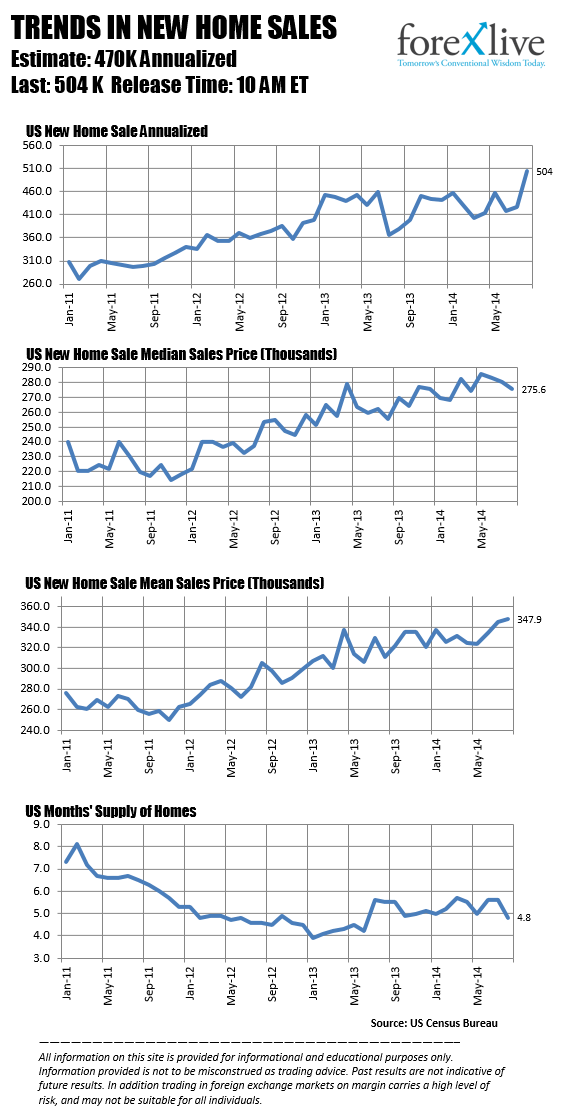

The New Home Sales is the only major economic release scheduled for the day in North America. The estimate is for a gain of 470K vs. the surprise 504K seen last month. Although the 504k was the highest since May 2008, the peak has been 1,389k (in July 2005). In 2007, the high watermark was 891K. So, activity remains well off of activity peaks seen in the go-go days of the housing boom.

This release, along with the stock market and any news on Ebola in NY, will be the focus. Quiet? or do we pick up and extend ranges? I don’t like Fridays.

New Home Sales to be released at 10 AM ET.