The NZDUSD marched lower yesterday and got a Trade Balance number that was much worse than expectations – or was it?

The Trade Balance came in with a deficit of -1350 for the month. This was a record deficit. NZDUSD goes lower, right? Not so fast.

The mix showed 3.61B of exports which was higher than the 3.5B expected and Imports rose to a record 4.96B (vs 4.20B expected). Imports and exports both rise take the sting out of the data. Good number after all. Buy NZD.

Hold on though. The import number includes new Boeing Dreamliner 787 which was not included in the July number. Apparently, there was a change in heart and they decided to revise July and include the imports in September as well.

So July was imports were revised from 4.41B to 4.63B (NZD 220 million).

The report said that 3Q aircraft totaled 863M so with 220M in July, that means 643M was in September.

If that was excluded from the September deficit of -1350m, the non-aircraft adjust deficit would have been -707M which is still higher than the -625M estimate but not a record. The Imports would have been 4.96B – 0.643 or 4.317B which is higher than the 4.20B expected but not as great.

So overall, Imports rose, ex-air and with air. Exports were higher than expected. Good news.

Then again….the Export trend is down. The 3Q fell 3% with dairy down 8.8%.

Oh the heck with it. Just listen to what the charts are saying….

——————————————

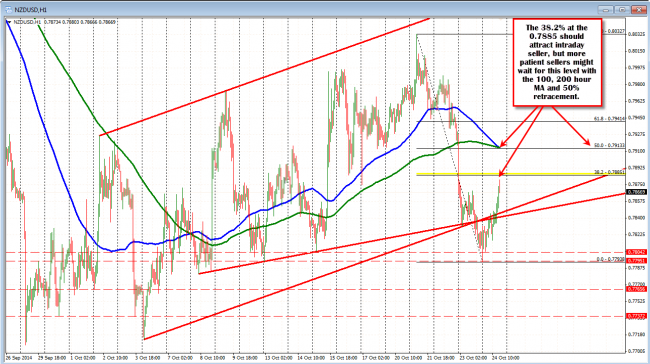

Technically, the NZDUSD rallied higher and is extending to new highs.

Looking at yesterday’s action, the price broke below some key trend lines yesterday and extended to the 2nd of 3 downside targets before starting to rally (see post Forex Technical Trading: NZDUSD tumbles on the back of lower CPI ). The move back above trend lines broken yesterday, has led to a further push higher. The down side market momentum could not be sustained and traders started to cover into the weekend.

NZDUSD approaches the 38.2% retracement.

The price is moving toward the 38.2% retracement level now at the 0.78851 level. I would expect that traders will be eyeing the action here. Does the patient sellers who missed the move lower show up here? Or is that 50% and 100 and 200 hour MA above at the 0.7913 level worth waiting for? It is Friday, so much depends on the week ending flows. Enter with that understanding..