Forex news for October 24, 2014:

- ECB draft doc says 25 banks to fail bank tests

- Fitch affirms Italy and Spain both at BBB+ with a stable outlook

- September 2014 US new home sales 0.467m vs 0.470m exp m/m

- Draghi repeats ECB ready to use other unconventional measures if needed – spokesman

- Russia rating affirmed by S&P, outlook remains negative

- Austrian finance minister says no surprises in bank stress tests

- Greece’s Samaras is looking for the bailout exit door

- French jobseekers hit fresh record high

- CFTC Commitments of Traders

- WTI crude down 84-cents to $81.25

- Gold down $1 to $1230

- S&P 500 up 14 points to 1959

- On the week, S&P 500 up 4.1% (Nasdaq up 5.3%)

One of the reasons Europe is sinking is that it has so many leaks. Nothing is kept secret in Europe and there’s now very little drama left in the stress test results after the major newswires obtained draft copies. It looks like 25 banks were asked to raise money and only 10 of 190 are on the naughty list.

No great trading theme developed in the FX market in US trading although stocks remained bubbly and that helped the US dollar but only mildly.

Ebola fears greatly dissipated and until there are signs about a genuine uncontrolled outbreak, I don’t think the market will flinch too hard on headlines any longer.

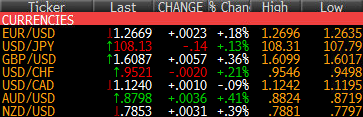

USD/JPY took a quick trip down to 107.78 early in US trading as stops were run on jitters but it bounced back quickly and we finish midway through the daily range at 108.13.

The Australian dollar put a bit of a squeeze on shorts early in US trading as the broad commodity complex did better. But the shine came off later in the day and AUDUSD drifted to 0.8797 from 0.8824.

Canadian dollar sellers are clearly lurking in the weeds and for the fourth consecutive day and test of 1.1200 in USD/CAD was rejected and the pair climbed back to 1.1239.

Have a great weekend!