Deutsche has cut China’s GDP growth forecast – by 0.5% to 7.3% for 2014 & by 1% to 7.0% for 2015

From Deutsche Bank strategist in Sydney. … what this means for the AUD:

A slower growing China is a negative for the AUD … primarily through lower commodity prices. (“Export volumes are less affected because Australia’s iron ore and coal miners —relatively low-cost producers — are typically not the marginal global producers, despite some high-cost operators feeling the pinch.)

They elaborate:

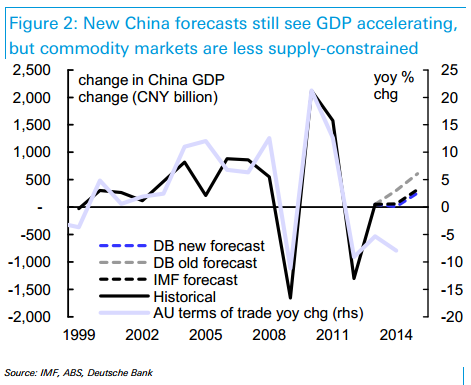

- Figure 2… The recent shift in the relationship between China’s growth and Australia’s terms of trade is probably explained by the fact that until 2012, commodity prices were supported by constrained global supply, but now that supply has increased, prices have fallen, pushing the terms of trade lower. Commodity supply growth is expected to continue

They conclude:

- While changes in AUD can lag changes in the terms of trade (Figure 1 ), we continue to see AUD/USD declining to 0.80 by the end of 2015.