I did a Preview of the BOJ announcement due on 31 October 2014. And here is a preview of today’s CPI data due.

Prior to the BOJ announcement, there is a big bucket of data to be dropped on the market.

Today its all due at 2330GMT (a little earlier than the normal time we get data from Japan).

- 2330GMT Overall Household Spending y/y for September, expected is -4.3%, prior was -4.7%

- 2330GMT Jobless Rate for September, expected is 3.6%, prior was 3.5%

- 2330GMT Job-To-Applicant Ratio for September, expected is 1.10, prior was 1.10

- 2330GMT National CPI y/y for September, expected is 3.3%, prior was 3.3%

- 2330GMT National CPI y/y excluding Fresh Food for September, expected is 3.0%, prior was 3.1%

- 2330GMT National CPI excluding Food, Energy y/y for September, expected is 2.2%, prior was 2.3%

- 2330GMT Tokyo CPI y/y for October, expected is 2.7%, prior was 2.9%

- 2330GMT Tokyo CPI excluding Fresh Food y/y for October, expected is 2.5%, prior was 2.6%

- 2330GMT Tokyo CPI excluding Food, Energy y/y for October, expected is 2.0%, prior was 2.0%

If you are looking at those prior CPI results and what is expected today you may well think that the BOJ has done its jon, easily hitting the 2% inflation target, and indeed exceeding it.

BUT … and I noted this earlier (and last month, and the month before that, and ….). Here it is again:

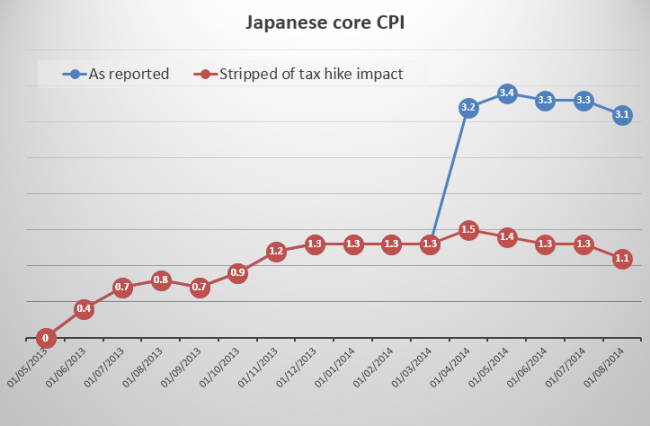

The Bank of Japan has estimated that the sales tax hike – to 8 percent from 5 percent on April 1 – added 1.7 percentage points to the annual consumer inflation rate in April, and 2.0 points from the following month.

I’ve also posted this recently … Useful chart from the Financial Times (FastFT – subscription required):

So, inflation is not at target, nor is it moving in the right direction.

BUT … Note, this week we have had some better data from Japan: