via eFX:

—

Investors are almost uniformly bearish on the euro, but their positioning appears to be lagging, at least on the real money side, notes UBS.

- “The fundamental picture is gloomy for the Eurozone, but this is widely expected and might thus be in the price. Economic underperformance may thus not be enough to drive the euro down,” UBS argues.

ECB frictions:

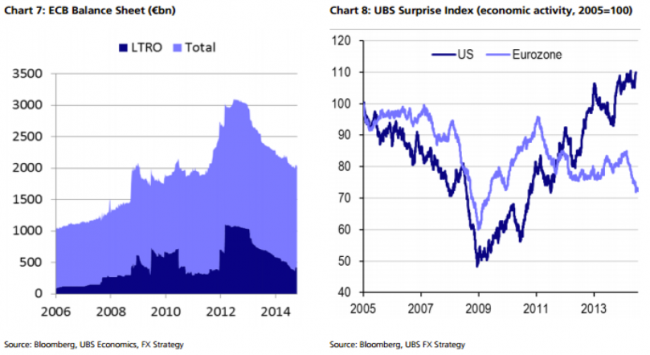

- “The euro remains highly sensitive to ECB actions. Yet we do not currently expect full-fledged QE, not least as headline inflation is likely to rise over the next few months if only on base effects,” UBS adds.

Mixed fundamentals:

- “Fundamentally, the large external surpluses remain a positive. However, global reserves not growing anymore might turn into a negative as diversification flows have provided substantial euro support over the last few years. Yet the most important euro negative might be exogenous once again: The Fed slowly but steadily normalising its monetary policy stance,” UBS clarifies.

All in all moderately bearish:

- “Our analysis of the various cross currents leaves us moderately bearish on the euro…As a result, we stick to our 3m EURUSD target of 1.25, envisaging a more aggressively bearish call only if the Fed were to accelerate its pace,” UBS projects.

–