Comments from Kocherlakota:

- Failure to respond to ‘arguably worse’ inflation outlook risks credibility

- Fed should ‘do what it takes’ to reach inflation goal as soon as possible

- Fed could have kept buying bonds to boost inflation

- Fed could have committed to keep rates near zero until inflation outlook rises

- Fed needs to show determination on inflation goal

- Full statement

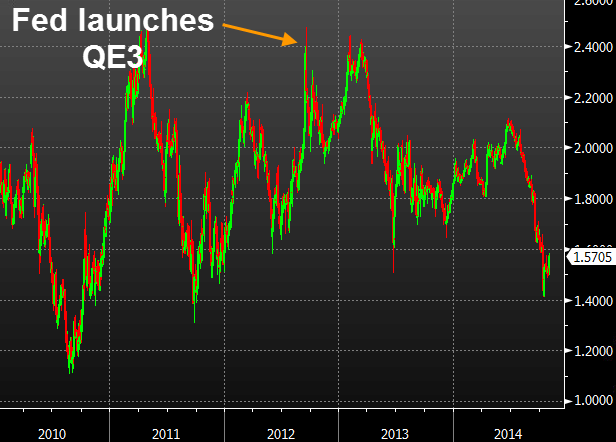

What Kocherlakota is talking about are 5-year breakevens, which are a proxy for what the market is expecting on inflation.

5 year breakevens

A big part of that is the fall in oil/commodity prices but they’re near the lowest since 2011 and indicating just 1.57% inflation, on average, for the next 5 years. So either the market is wrong or the Fed is.