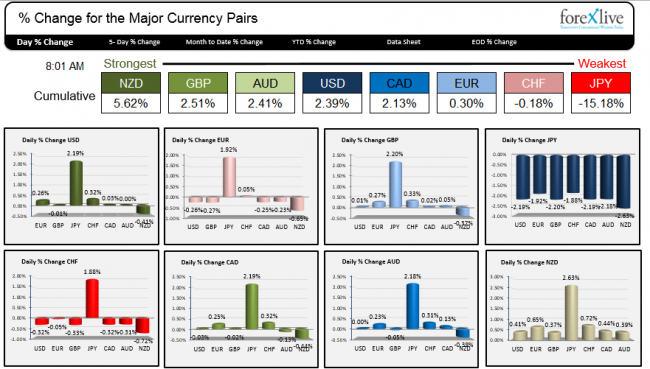

The BOJ easing is taking center stage and has sent the JPY tumbling lower. The pair is the overwhelming weakest currency and rightfully so as the carry trade swings into full gear. The strongest of those carry trades is the NZDJPY as NZD has the highest rates. The NZD is up against all the major currency pairs. The greenback and GBP are the next strongest currencies behind the NZD. US ends QE, Japan increases. EU looking to add more too. RBNZ? It will be hard to fight the carry fundamentals unless they ease with the rest. The pendulum is swinging and the the USDJPY at 111.60 is the result.

The NZD is benefiting from the carry trade. The JPY (surprise. surprise) is the the weakest.

Outside the NZD, the EUR and CHF are the next weakest as the currency war scenario heats up. The good news for the EUR today is at least the CPI did not follow the way of the German CPI and instead came in as expected at +0.4% – a 0.1% increase from last month’s +0.3%. German Retail Sales were quirky. The MoM fell by -3.2%vs.-0.9% and the prior month was revised to 1.5% from 2.5% but the YoY rose to 2.3% vs 1.2% estimate. How did that happen?

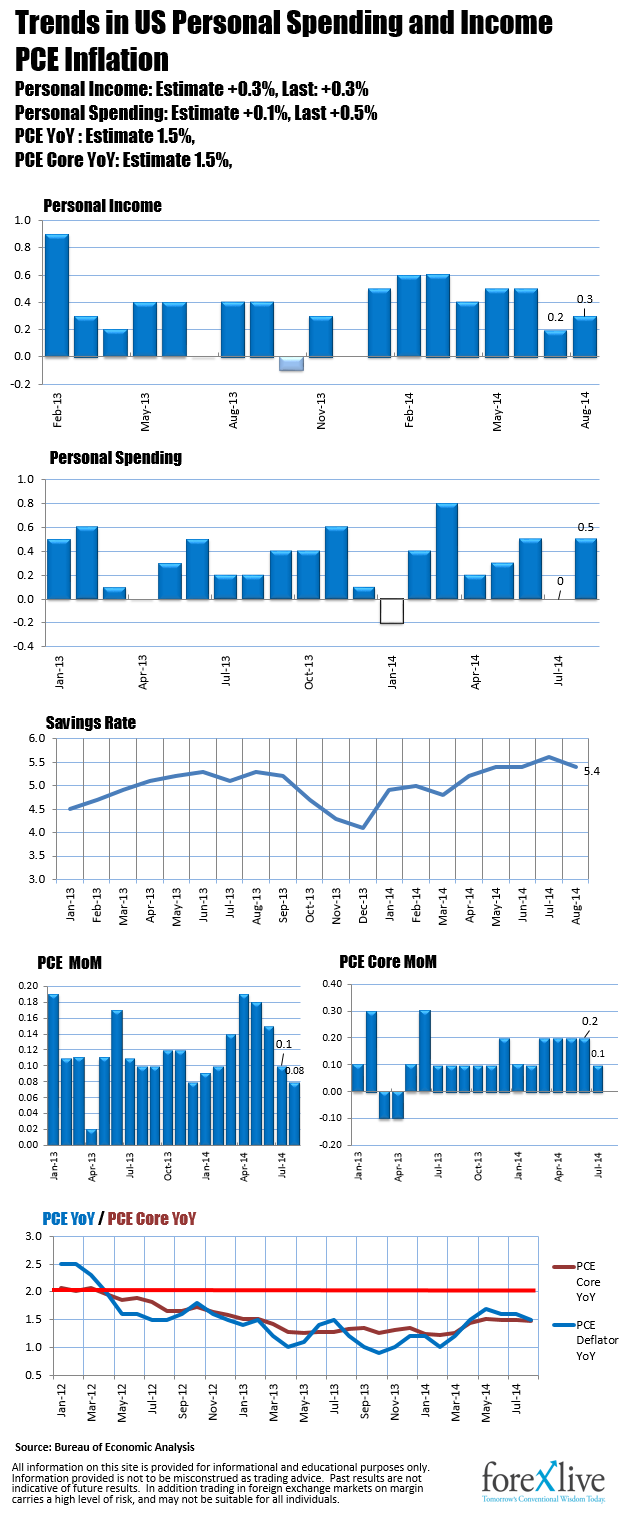

Today in the US, the Personal Income and Spending will be due at 8:30 AM (+0.3% and +0.1% estimates). PCE data will also be released (+0.1% MoM, Core also +0.1%). Chicago PMI will be released at 9:45 AM ET and Michigan Confidence (86.4 est unchanged from the previous estimate) is due.

US Personal Income/Spending and PCE trends.

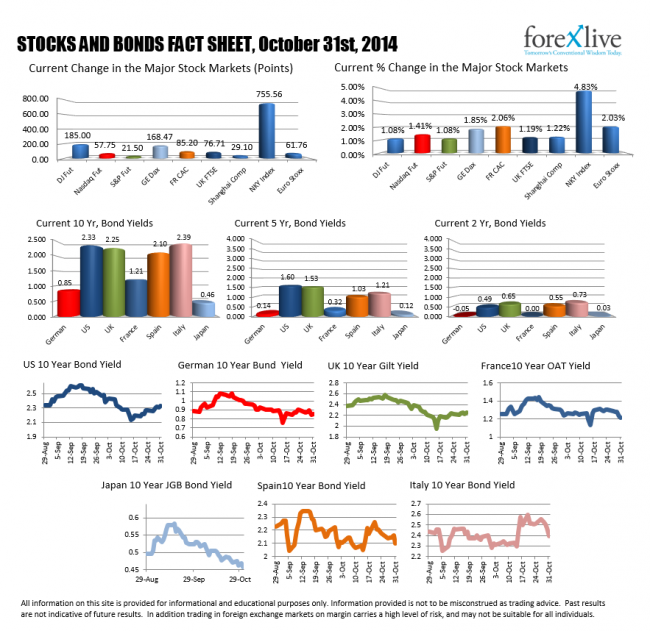

Stocks and Bonds

The Nikkei surged – up 4.83% – and it’s gains are helping the European stock markets as well with the EuroStoxx up around 2%. The US pre-opening prices are showing higher openings as well with the Dow Futures near +200 and Nasdaq near up 60 points. The US Bond yields are up 2 basis points from this time yesterday while German 10 year bunds are down a basis point. That spread has moved higher over the last few days which favors the USD.

Global Stocks are loving the extra liquidity coming from outside the US this time.