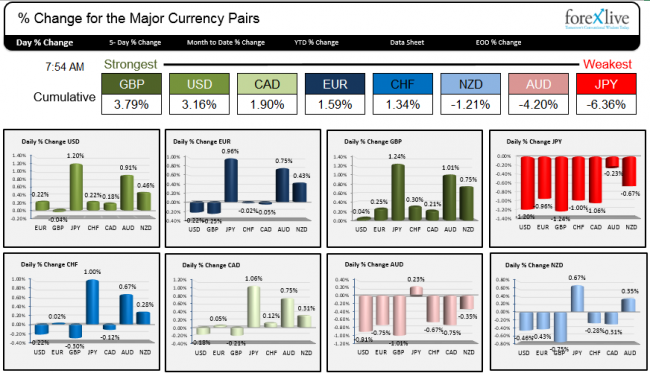

The JPY continues to be the weakest currency as it continued the trend lower after the Friday surge on the back of the BOJ stimulus. The USDJPY is up by an additional 118 pips. The GBPJPY has risen 200 pips and the EURJPY is up 120 pips or so from the close on Friday. The currency is lower against all the major currencies. The Nikkei soared 4.83%.

The Strongest and weakest currencies in trading today (a snapshot)

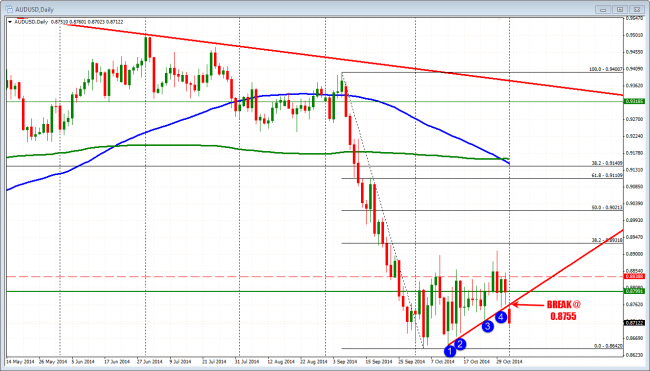

Also weak today is the AUD. The AUDUSD gapped lower on the back of lower China Manufacturing (50.8 vs 51.1 last month). The Reserve Bank of Australia will announce their interest rate decision later today. No change in policy is expected although the market will once again be focused on the language within the statement. In the October 7th statement, the RBA said the following about the currency:

The exchange rate has declined recently, in large part reflecting the strengthening US dollar, but remains high by historical standards, particularly given the further declines in key commodity prices in recent months. It is offering less assistance than would normally be expected in achieving balanced growth in the economy.

Since that time, the AUD is down about 100 pips currently as October was largely non-trending. Today, the move lower has taken the price below trend line support on the daily chart.

AUDUSD broke below trend lined support at 0.8755.

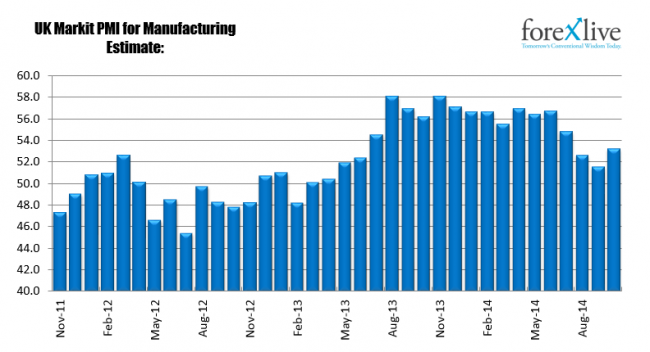

The strongest currency is the GBP which was helped by better than expected Manufacturing PMI data. The Markit Manufacturing PMI came in at 53.2 vs 51.4. This reversed a 3 month decline in the index which saw it come down to the lowest level since April 2013.

UK Markit PMI comes out better than estimates at 53.2 vs 51.4.

The GBPJPY is trading at the highest level since October 2008 and moves closer to the next major target at the 50% of the move down from the 2007 high to the 2012 low at the 184.178 level (see chart below).

GBPJPY trading at the highest level since 2008.

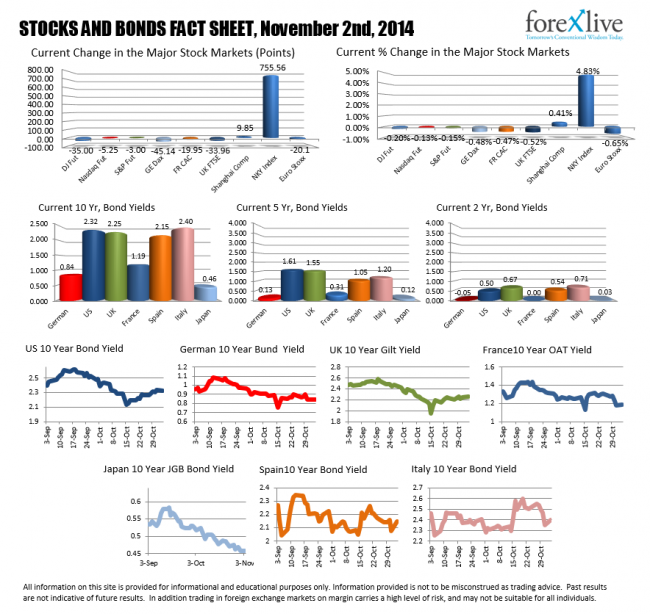

Stocks and Bonds

The Nikkei Index soared 4.83% in Japan trading today. The European and US pre-opening stocks are not doing as well with decline of around 0.5% in Europe. The DJ futures are down -25 and the S&P is down -3.00 in pre-market trading.

Stocks and Bonds Snapshot

In the US today, the Markit PMI for October (final) is due at 9:45 AM ET. The preliminary came out at 56.2 and that is the expectation today. This is down from 57.5 last month. The high going back to 2011 was 57.9 reached in Auguast 2014.

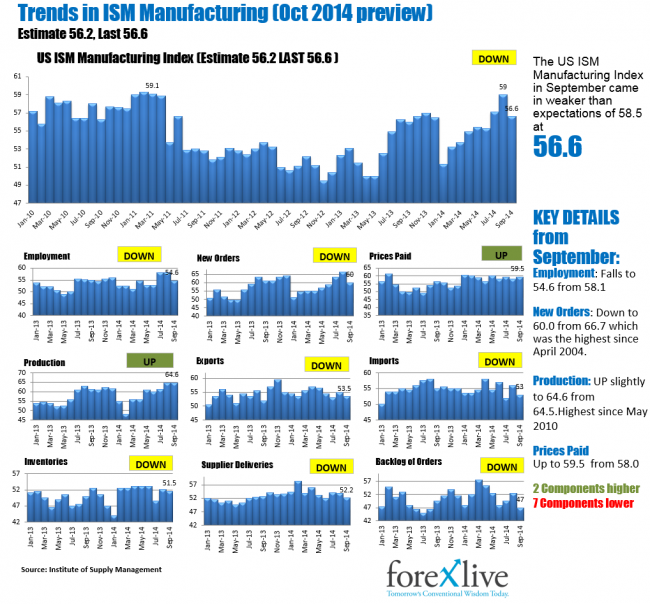

At 10 AM the ISM PMI Index is expected with the index estimated to fall to 56.1 from 56.6 last month. Below are the trends in the Index. Feds Evans will give the opening remarks at the Chicago Fed Conference at 9:30 AM ET. US Construction Spending is expected to show a 0.7% rise vs. -0.8% decline in August. Auto sales in the US will be releases with the expectations for 16.4M total vehicle sales vs. 16.34M last month. The Domestic sales are expected at 13.1M vs 12.89M.

Trends in the US ISM Manufacturing Indices.