Do you think we’ve come a long way so far?

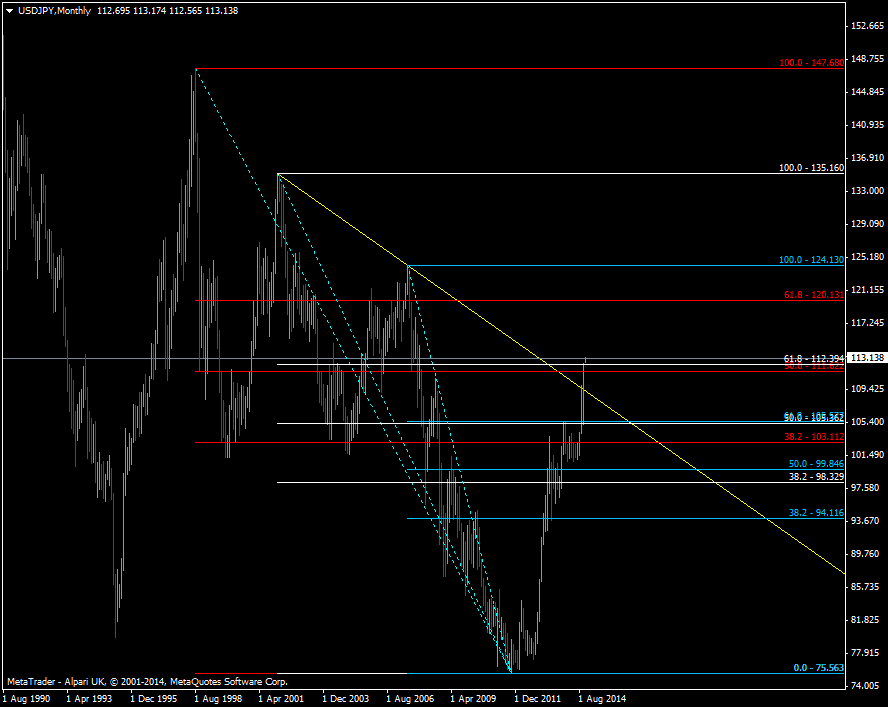

Relatively speaking, yes we have. Looking at the monthly chart again we’ve seen a very big move against multi year levels.

USD/JPY Monthly chart 03 11 2014

But let’s put that into some context by looking really long term.

USD/JPY yearly chart

Unless you’ve got decades of patience in your bones, trading charts like these isn’t easy. What they do give is an idea of potential and where some of the big technical levels are waiting. It’s all relative though as we have to take the fundamental situations at the time into consideration.

In the current situation what have we got? The BOJ trying to re-spark the economy has now gotten the Japanese QE brigade probably expecting more to come. They and the BOJ might start to run into some headwinds though. The Fed have been starting to cite the strong dollar as a potential problem for the economy and if they were doing that at 108 they’re likely to be doing it even more at 113 or higher.

The fact that the Fed have gave the BOJ a green light to fix their economy has been just as much a reason for the currency rising from the mid 70’s to the 100’s and it’s just as much in the US’s favour that Japan recovers as it is for the Japanese, with so many Japanese companies tied into the US. It’s been mutually agreeable so far.

The question is how much further will the US allow the currency to run before they really start to put the brakes on it to protect themselves? In my view we’ll start to hear stronger rhetoric out of the US but that might be nothing more than hot air. Rate rises are still coming unless something major happens to something like inflation. So the US could be pissing into the wind in trying to halt the dollar’s rise with talk alone, and they don’t really have any policy tools to stem it either, particularly with a recovering economy. If manufacturing starts to take off then they’ll nearly have a full sector recovery and that should bring some inflation with it. That will bring rate chatter front and centre and we’ll be going up again on that.

And what of Japan? Kuroda hit the print button again to stem the fallout from the tax hike and at the moment the Japanese recovery is looking very dead cat-ish, as is inflation. After over 1 1/2 years in power Abenomics is coming under the spotlight and the honeymoon period is well and truly over. If there is any talk political shocks from Japan then that will mark the top in USD/JPY as it will likely mean the end of Abenomics and the possibility of Japan slumping back again.

So let’s put that into some tradeable terms.

Go with the flow and these upward moves if you can, but be prepared to hear the Fed become more proactive on the currency strength. If they start linking the currency with inflation and then link that to keeping rates low or unchanged then that will be the time to turn direction into shorts. There are plenty of factors on either side of the dollar balance board right now and the big money will be made in seeing when the balance tips one way or another.