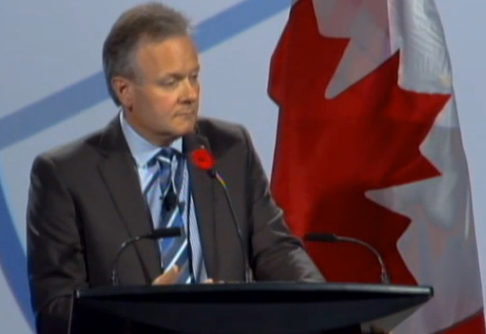

Comments from Bank of Canada Governor Poloz:

- Possible that effects of deleveraging, fiscal normalization and uncertainty will restrain global growth

- Canadian housing and financial situation very different from US just before crisis

- Some of the current strength in inflation is due to temporary factors

- Labor conditions point to material slack in Canadian economy; should take around 2 years to use up excess slack

- Continued mon pol stimulus stimulus needed as economy uses up excess capacity

- Stimulus may be needed after capacity absorbed if headwinds persist

On a quick read of the headlines, it strikes a dovish tone. If he’s saying it will take 2 years to cut the economic slack that means rate hikes are at least 15 months away and saying rates can stay low after the slack is used up adds another 6-12 months to that.

The market has been very slow to interpret these comments but USD/CAD is finally starting to move to the upside.

The actual speech will be delivered at 12:50 pm ET and is broadcast here. He will have a press conference at 4 pm ET.

Poloz today