The Canada employment report was better than expectations. The net change in jobs increased by 43.1K vs -5K estimate. This is on the back of a 74.1K gain in September. The Unemployment rate also fell sharply to 6.5%, the lowest level in 6 years.

USDCAD had a lot of break in the first minutes. Consolidating with 1.1346 a level to get back below.

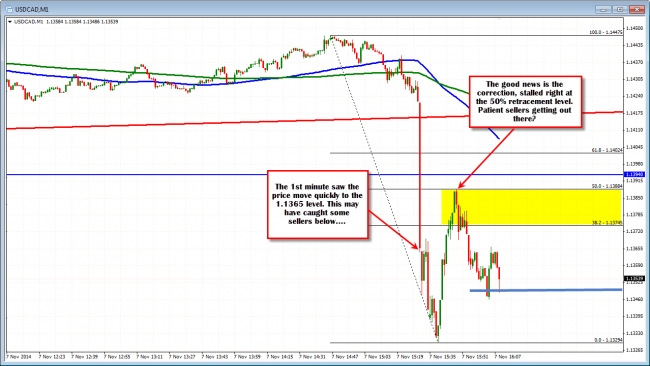

The USDCAD fell sharply on the news, breaking below trend line support (at 1.1405), the 100 hour MA (at 1.1394), trend line from the October 29 low (at 1.1346), and briefly below the 38.2% of the move up from the October 29th low to the November 5 high (at 1.1334 – see chart above). The price is rebounding a bit and moves back above the lower trend line at 1.1346. Watch this line now for trading clues.

Sellers started to take back some control on the break lower. However, the one problem, is the selling lower was done at lower levels. Looking at the 1st minute when the sellers were scrambling, the low reached down to 1.1365. So new sellers may be caught below.

Nevertheless, the better data should attract sellers on rallies by the patient sellers. The 50% of the move down today comes in at the 1.1388 and that is the corrective high. So sellers did show up there. Stay below this level will be a bearish sign today. Move above and I would expect more upside potential with a retest of the 100 hour MA likely (blue line in the chart above at 1.1393 area).

So watch the 1.1346 level below. Watch the 1.1388 level above. Those are the battle lines for traders today.

The 1 minute chart shows quick plunge lower followed by retracement to 50%. Seller in control.