Danske bank like the buck against the swissy and suggests buying it at current levels for a run to 1.0200 with a stop at 0.9400. They see the US hiking rates in June with a risk of an earlier rise and would prefer to play the dollar vs the Swissy rather than the euro.

While they see EUR/CHf pressured in the short term over speculation of further ECB easing and the swiss gold referendum they expect it to rise slowly to 1.24 over the next 12 months on a reversal of safe haven flows and an increase of Swiss investors increasing foreign portfolios.

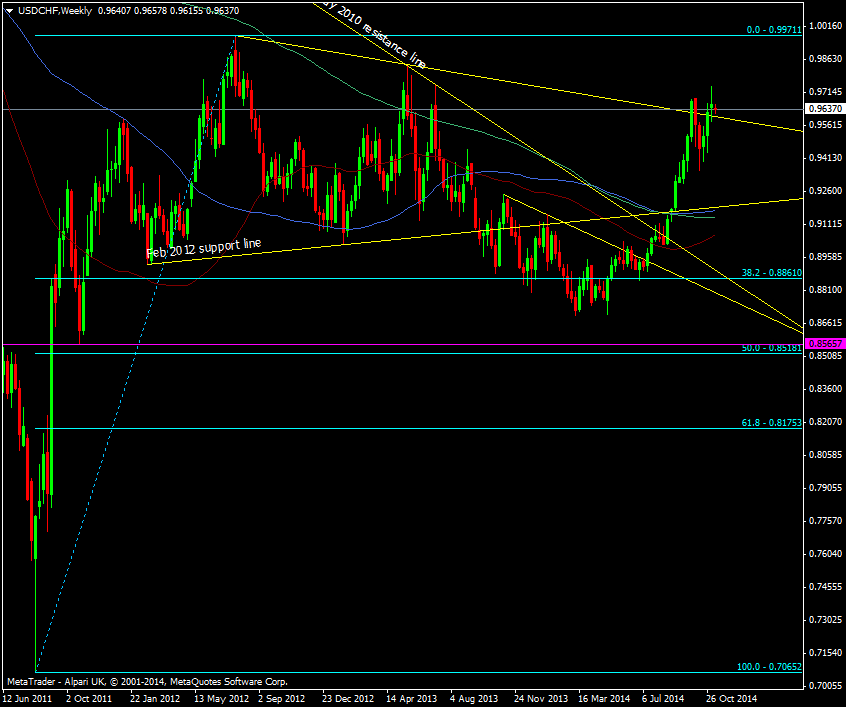

I quite like the look of the confluence of the 100& 200 moving averages on the weekly chart, as well as the Feb 2012 support line so if we did get another wobble in the buck that would be my ideal choice to pick up longs. At over 400 pips away though, I won’t be holding my breath.

USD/CHF Weekly chart 10 11 2014