The USDJPY was boosted higher in trading today on the back of the speculation that PM Shinzo Abe would delay a proposed sales tax and prepare for a snap election next month. It would make sense given the extra stimulus to delay the increase. Nevertheless, the JPY has taken another step higher in trading today to the multi year highs.

Traders will no use the 115.50-55 as support today.

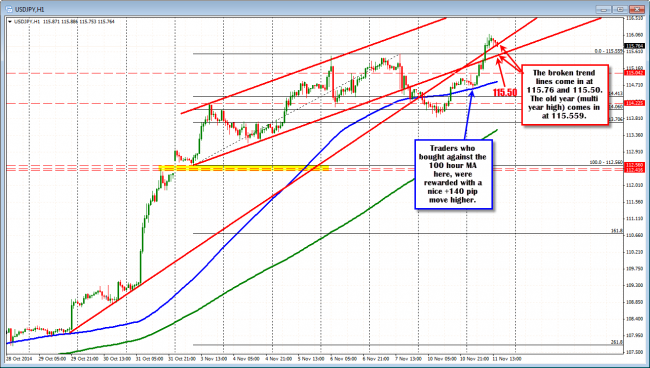

Looking at the hourly chart below, traders who got in against the 100 hour MA in the Asian session were the big winners (blue line in the chart above). The 100 hour MA came in at 114.62. The low for the day was 114.625. Risk could defined and limited against the level. Those traders who used the level to lean against were treated with a nice push higher (of course those already long benefited as well).

The price has also moved back above broken trend lines from the corrective move lower on Friday 115.76 and 115.50. The prior high for the year – reached on Friday – comes in at 115.559. I would expect today that traders will lean against the 115.50-56 as a buy area. A move back below the 115.50 level would not be what I would expect. If done, there should be some stops triggered by those looking for more upside today and going forward. The midpoint of the day’s trading range comes in at the 115.358 and this would be the next downside target. A move below that level and the market will start questioning the bullish trend move higher today.

On a move below the 115. 50 area, the market will next focus on the 50% of the day’s trading range.