Earlier today, (SEE: Forex Technical Trading: EURUSD remains within the confines of the weeks trading range) we were set up to head lower and extend the narrow trading week’s range to the downside.. The price got within a few pips of extending that range lower, but buyers entered, the price moved higher (above some technical levels) and now the price is breaking above the high for the week at the 1.2508 level. How about that for a reversal?

Reversal and extension above the weeks highs.

The pundits will write a story about the move and why it happened and I wish them luck. However, from a technical perspective,the price action simply did not do what I thought it would do, and when the price moved above specific lines in the sand early on, the bias turned around and sellers became buyers.

Looking at the 5 minute chart below from earlier today, the initial move down – helped by stronger Retail Sales – broke below the earlier low for the day and the lower trend line.

I wrote in the aforementioned post:

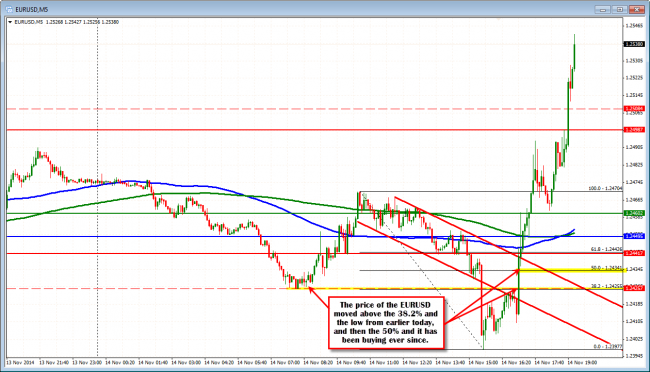

Looking at the 5 minute chart, the move lower in the London session has moved below the late Asian low at the 1.24255 level. This is the 38.2% of the London move lower and near the broken trend line support (see chart below). It is Friday so, there can be swings from end of week flows, but if the sellers like the idea, there should be sellers in the 1.24255 area. A move above the 50% of the move lower at 1.24341 would take some of the bearishness out of the pairs bias. Friday’s can chop around – so be aware.

This is the chart, I was referring to:

EURUSD fell on the better Retail Sales today.

This is what that 5 minute chart looks like now.

The technicals put into question the downside. The upside move was more a surprise.

The Retail Sales and later the Michigan Consumer Confidence (which was better) did not lead to a higher USD but instead started the buying of the EURUSD when it could not go lower. Short covering? Squeeze? How ever you want to term the move, it simply did not do what you might expect. The triggers for buying, was hen the price moved above the 38.2 retracement 1.24255 level, and the 50% at the 1.24341. The buying intensified.

The move today reminds me of a video, I did a few weeks ago when a similar dynamic occurred. I repost that video as a reminder of how the market can whip around. The “story” today is different, but the price action is similar (even more pronounced). The price action and the technicals told the “story”.