What a gift that pop to 117 was after the shocking miss from the GDP numbers. I hope many of you jumped on it.

The Nikkei has been hammered right into the close and ends down 2.96% at 16973.80

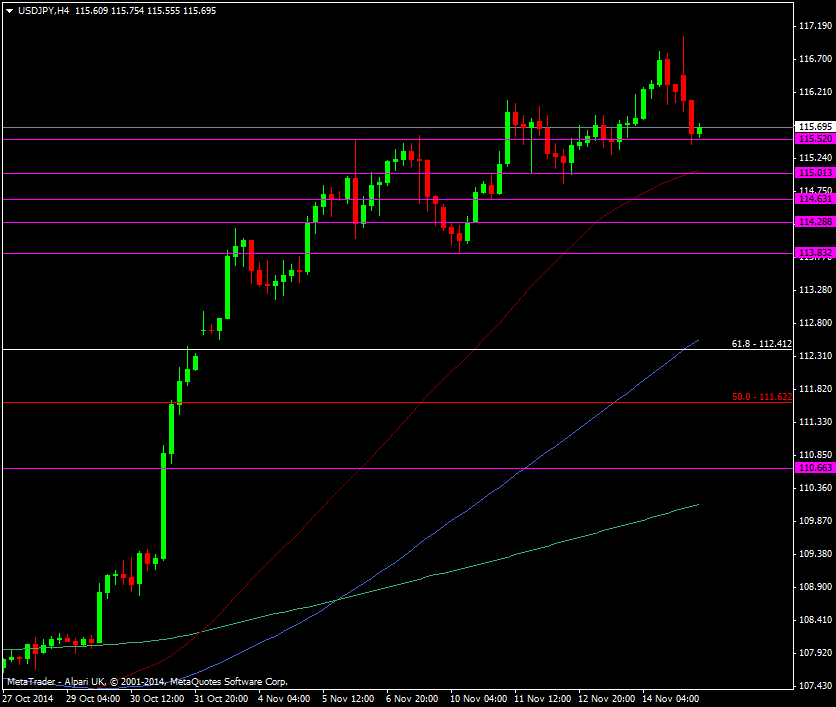

USD/JPY is off around 150 pips since that 117 high and into a former S&R level at 115.50.

USD/JPY H4 chart 17 11 2014

The moves over the next couple of sessions are going to be very crucial. While we may see more pain for the pair and the Nikkei the market is going to have one eye on the BOJ and whether they act again and that may slow or limit the fall in USD/JPY. With hindsight being the wonderful thing that it is, it looks like the market was looking in the wrong direction when they surprisingly upped their stimulus the other week. Instead of being worried about inflation you’ve got to think they saw these numbers instead.

The other thing we need to monitor is whether Abe is on as sound a political footing as he was before the numbers. This is a very big blow for him and we could well see disquiet rising from in his ranks that Abenomics is more than stumbling. That might make the upcoming election even more of a big risk event than the market has been pricing in.

Lastly, let’s not forget the US side of the trade which could also help keep the dollar buoyed. We’re still looking at an improving economy and the first of the manufacturing data is out today and if it’s good then at the very least it should keep the pair afloat until the Asia session.

It doesn’t take a lot to switch sentiment in the market and for the last couple of weeks it’s been an all out bull trade with both the US and Japan giving no real reason to sell it. These GDP numbers have turned it right around from the Japanese side so it’s now a more even trade.

I suspect we’ll get a little uncertainty over the next few days but the upside is going to be more of a struggle than the downside.

If we drop then the levels above may make it slow going and it’s going to be a move down towards the former long term fib levels that could be decisive.