“Inflation” is the keyword these days and whether the developed world and its economies are going to tumble into a disinflationary spiral. One country that hasn’t looked like it’s going to do so is our friends from the badlands where “temporary” inflation has been trending up for 2 years.

That’s not stopped USD/CAD from touching five year highs around 1.14 as the BOC keep its rhetoric on interest rates at neutral.

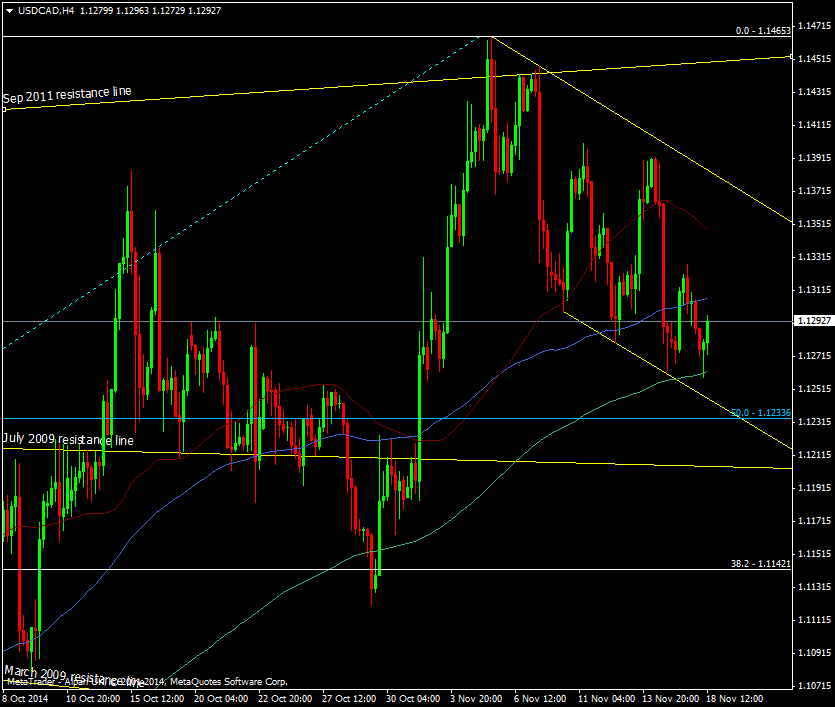

The loonie maxed out not far above the Sep 2011 resistance line and it’s been downhill ever since. Obviously the oil price moves are playing a big part but even so we’ve developed into a short term trend lower which is giving us a defined range to play.

USD/CAD H4 chart 18 11 2014

Several boundaries are in play for both long and shorts in the pair. The upper downtrend line can be traded short with a stop on a break of the Sep 2011 line and the same can be done with a long from lower downtrend line, with a stop below the old July 2009 line.

If the market sees inflation rising in the US and goes looking for rate rises then the dollar will obviously be in demand, That may also help tip the BOC into an earlier move, particularly if inflation continues to rise as they’ll need to potentially act quicker than those south of the border.

I’ve been keeping tabs on Canadian CPI for a while, as you may well know, and I’m not convinced that falling inflation is not going to be big problem in either country. I guess we’ll find out a bit more on Friday.