Preview of the FOMC Minutes to be released November 19, 2014 at 2 pm ET (1900 GMT)

The Oct 29 FOMC decision will be remembered for upgrading the employment assessment by removing the a reference to ‘significant’ slack in the labor market and ending QE. What the minutes will be scanned for is the assessment of inflation.

A key metric at the moment is 5-year breakevens, they imply just 1.53% average inflation over that time period, well below the 2% target. With oil prices falling even hawkish FOMC members like Plosser aren’t worried about price rises.

If the Fed sounds alarms about low inflation and inflation expectations, it will hurt the dollar and put added emphasis on Thursday’s CPI report.

‘Considerable Time’

The FOMC left ‘considerable time’ in the statement despite winding down QE. The Fed has emphasized more data dependency and with inflation low that could stretch out the timeframe for the first rate hike. Any hints on when that will come will be key for the initial kneejerk in markets.

QE talk

In the lead-up to the decision, Bullard mulled continuing QE but markets later rebounded and in the end it was likely an easy decision to finish the taper. But any discussions could be noted, especially if the doves prove relatively strong.

Reinvestment

Before the Fed hikes rates it may halt re-investing expiring bond purchases. This could be the surprise of the minutes because there is no clarity right now on whether ending reinvestment comes before a rate hike or vice versa. Talk of halting reinvestment would be good for the dollar.

FX Impact

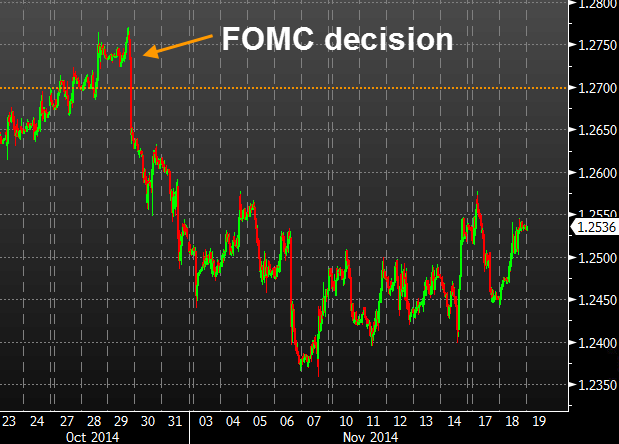

The US dollar has been strong since the decision but part of that is because elsewhere is weak. If the Fed really believes inflation is coming, this could be just the start of USD strength.

EURUSD since the FOMC decision

Essential reading:

- Highlights of the Oct 29 decision

- Full text of the FOMC statement