ForexLive October 2014 UK retail sales report preview 19 November 2014

It’s shop stat time again and we get to see how loose the UK public has been with the purse strings this month.

First we’ll take our usual look at a couple of indicators I like to delve into for a little chaser before the main event.

Lloyds consumer barometer shows job fears rising

Due to the date that sales have fallen on I’m without my Lloyds consumer confidence survey which gives a great insight into spending habits during the month. So, with one hand tied behind my back already we’ll have to look elsewhere.

Fortunately Lloyds also run a consumer barometer which mainly looks at inflation expectations, but has a couple of components that we can draw from.

I’ve mentioned previously that the if the economic slowdown hits sentiment and jobs then we will see the ripple effects through the rest of the economy. The Lloyds report for October has shown that job security and employment prospects both fell. Job security fell to -7 from 0 and prospects to 0 from 10. We also saw a drop in prices seen and expected in the inflation gauges.

Retail sales is one of the first indicators to show the effects of a change in sentiment to jobs. If people are not feeling secure about the future, they won’t feel secure in splashing the cash. I wouldn’t say anyone is in panic mode over jobs yet but the early warning signs are there. That’s one negative slant that we could see in sales. It’s also one to keep an eye on for the labour reports

BRC retail sales show clothes sellers were left hanging

Unseasonably warm weather at the end of October has left clothing retailers high and dry and more “tricked than treated”, said survey hosts KPMG. Head of KPMG retail, David McCorquodale, said;

“Sadly this warmer weather has left many fashion retailers with substantial stock overhang, raising the question of earlier and deeper discounts as we get close to Christmas.”

Like for like sales were flat compared to a year ago but were up 1.4% m/m vs -0.8% prior. October 2013 saw month on month sales rise 2.6%

Once again furniture and homewares was the leader in sales while food sales continued to fall. Furniture are bigger ticket items so it’s hard to see that continuing for too long. Online shoppers of non-food items rose 15.4% y/y from 12.1% in 2013 and the highest growth since Christmas 2013.

Small wonder that food sales fell again

Overall it’s a mixed report as the warm weather hit winter clothing but may have boosted other areas as people took to the streets for Halloween. Certainly around my way you couldn’t move for brats knocking on doors.

So far there’s nothing from the two reports to say that we’re going to get a bumper sales report yet there’s one important aspect we need to start factoring in, inflation.

Falling input costs are making everyday things cheaper and that could be giving people a little boost to their everyday finances. Save a fiver on petrol and that may be spent elsewhere. We didn’t really see any effects of that last month but we could well do this month. It’s a bit of an accounting trick though as that fiver from petrol comes off the fuel spend component of sales and gets added to the ex-fuel one (we hope) if it doesn’t then we’ll not see the passthrough and sales will be lower.

As we saw from the inflation numbers yesterday, games and toys have seen prices rising and that’s a good indicator that sales are up too and we’re not yet seeing any pre-Christmas discounts. The UK has got the Black Friday sales bug this year but that’s happening this month and will be where the big discounts are (set reminder for Nov sales data).

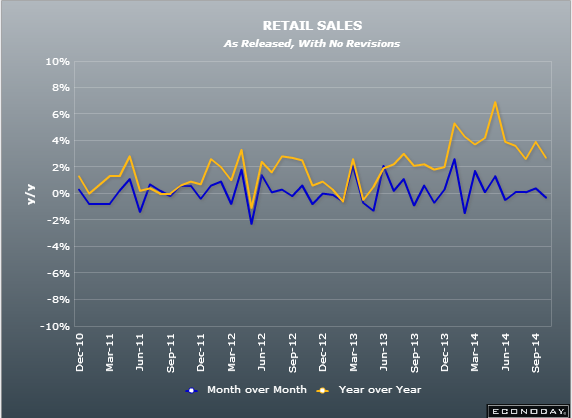

Sales are expected in at 0.3% m/m vs -0.3% prior and 3.8% vs 2.7% prior y/y. Ex-fuels sales are tipped to be up 4.2% from 3.1% prior y/y.

UK retail sales September 2014

The pre-retail indicators last month were pretty much spot on and it’s a shame we don’t have the Lloyds consumer confidence numbers just to cement the findings this month. Overall I think the expectations are pretty spot on and there’s a chance we could see a variation either way. It’s going to make trading it tough and we’ll have to be reactive to the data rather than proactive. The inflation numbers have given the pound a reason to stop falling momentarily so that should be our bias. If we see a drop on just a mildly bad number then we might have a buying opportunity to fade the move. If it’s horrendous then all bets are off. A good number may give the pound a boost but it might be worth looking for value in other pairs and crosses rather than directly against the USD, if the buck is still well bid. I still wouldn’t chase any moves though.