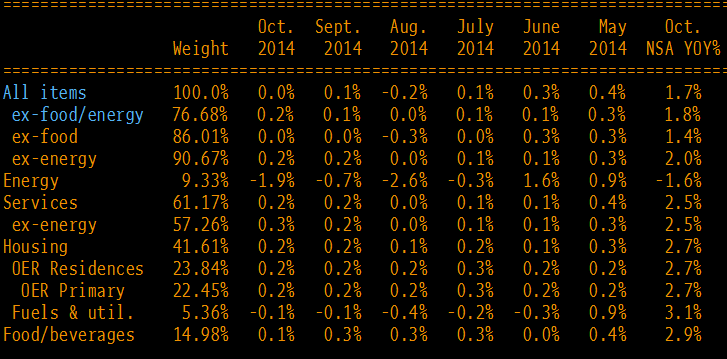

Highlights of the October US consumer price index report:

- Prior reading was +1.7% y/y

- Ex food and energy 1.8% vs 1.7% y/y exp

In monthly terms:

- CPI 0.0% m/m vs 0.1% exp

- Core +0.2% vs 0.1% exp

- Real weekly earnings +0.4% m/m vs +0.3% exp

Stronger than expected but the US dollar reaction was subdued. Softer jobless claims may be part of the reason why but the US dollar should be able to rally on these numbers.

Inflation in the services side is interesting. In the months ahead, lower commodity prices may filter through food, fuel and utilities.