- Prior 11.069bn. Revised to 10.571bn

- Ex-financials 7.706bn vs 7.900bn exp. Prior 11.830bn revised to 11.222bn

- Ex-intervention payments 4.4bn vs 12.6bn prior. Revised to 11.9bn

- PSNCR -2.592bn vs +17.700bn orior. Revised to 18.187bn

- Central gov NCR -3.7bn vs +21.7bn prior

Slightly up on the headline but the ex-financials will be of some comfort to the Chancellor and he’ll be hoping that he can maintain the fall in borrowing right into the election. He doesn’t have much wiggle room to offer incentives to voters while the numbers are at these levels. He promised to reduce debt by 10% in 12 months last March. There’s a big swing in the ex-interest borrowing so there’s a big skew somewhere. I’ll have a look for it now. The big swing is because of a switch to new calculations. I blooming well need all that on a Friday

On the tax front, Income and national insurance rose 1.5% from a year ago and that’s with the strong jobs market. That highlights the nature of jobs at the moment and point to more lower paid and possibly shorter hours contracts.

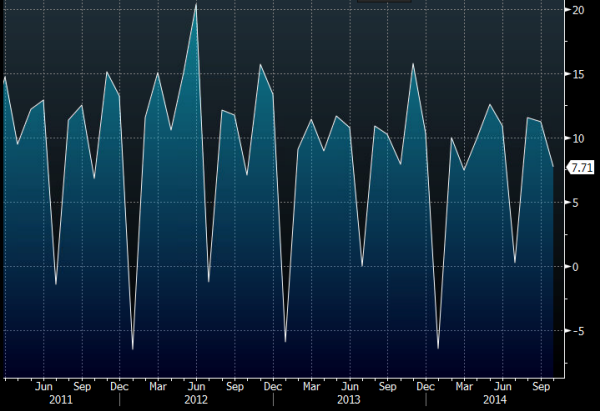

UK PSNB ex-financials 21 11 2014