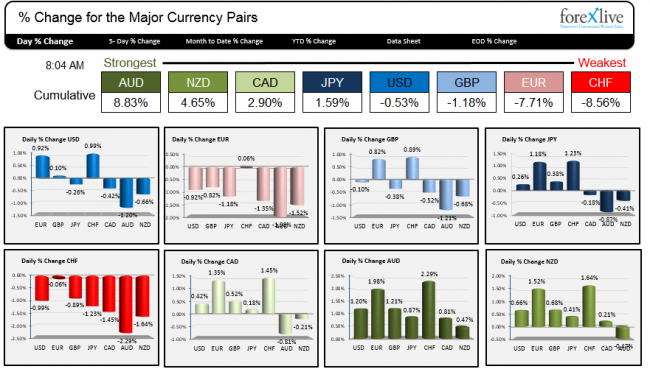

The AUD and NZD are the strongest currencies today as the People Bank of China cut their deposit lending rate in an attempt to support the economy. Specifically, the 1 year benchmark lending rate was cut by 0.4% to 5.6%. The benchmark deposit rate was cut by 0.25% to 2.75%. Earlier this week China reported that lower property prices and the HSBC Manufacturing PMI fell to 50.0 from 50.4. Both the Australia and New Zealand’s economies are influenced by the ups and downs of China’s economy through trade. Stimulating the economy via lower rates is a benefit.

The strongest and weakest currencies for November 21.

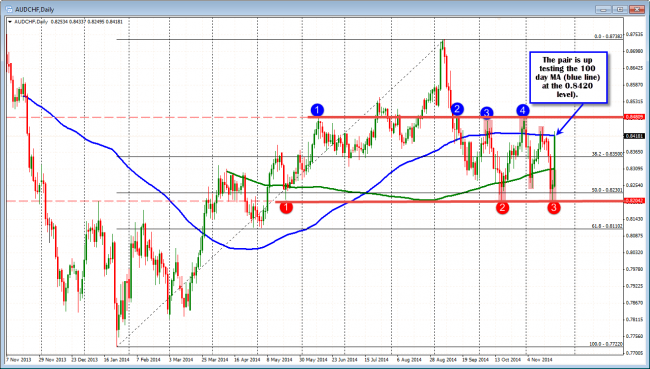

The AUD is strongest against the CHF. Over the last 2 months the pair has been trading mostly between the 200 day (green line in the chart below) and the 100 day MA (blue line). There have been extension above and below the key MA levels. The pair just yesterday tested and found buyers against the recent floor at the 0.82042 (see red circle 3 in the chart below). The rally today has taken the price to the 100 day MA (blue line) at the 0.84027 level. A move above would look toward a high ceiling area around the 0.8480-89 area. Currently, the pair is finding profit taking(?) sellers against the 100 day MA. A break will target the ceiling.

AUDCHF is up testing the 100 day MA . The price yesterday tested the low floor at the 0.8204 level and held.

The weakest currencies are the CHF and the EUR as ECB President reiterated that the ECB would broaden asset purchases should inflation outlook for the region diminish. The CHF is being influenced by the falling EUR and the expectations that the SNB will keep the EURCHF above the 1.2000 level. “SNB’s Zurbruegg says CHF cap is still absolutely key part of monetary policy”

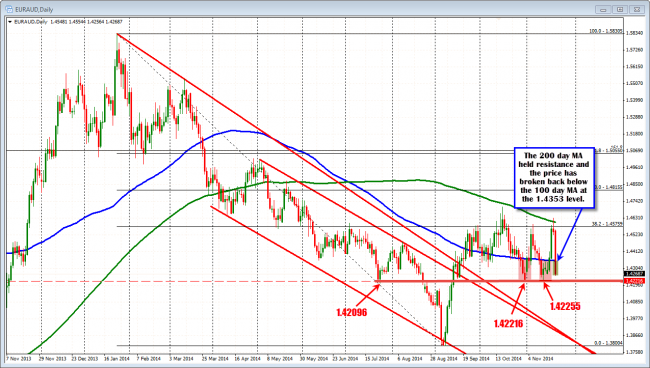

The EURAUD is the weakest EUR pair. The price yesterday was testing the 200 day MA (green line in the chart below) and sellers entered against the level Today they were rewarded with a nice move on the back of increased QE speculation in the EU and the PBOC easing which is benefiting the AUD. The pair has tumbled below the 100 day MA (blue line in the chart below) at the 1.4353 level. The pair has been moved below the 100 day MA on two separate occasions in the last three weeks of trading – with lows of 1.42216 and 1.42255. Traders who are short will likely now use the 100 day MA as risk defining level with the hope the 1.4221 area is broken and a further move to the downside can be started.

EURAUD is the weakest currency pair against the EUR

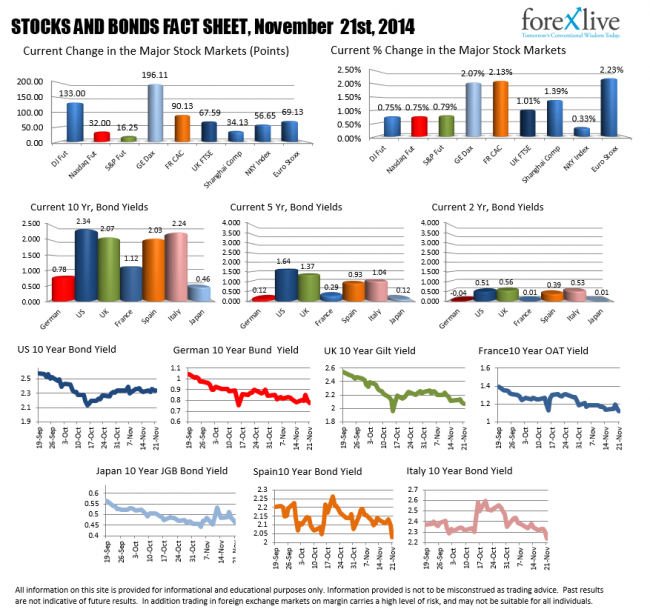

Stocks and Bonds

The European and US pre-market stocks are higher in trading today on the QE chatter. Bond yields are falling in Europe. Italian (2.24%) and Spanish (2.03%) yields are falling the most as fears of inflation push the money out the curve and into the “higher” yields (German 10 year is at 0.78% and France Oats are at 1.12%).

Stocks and Bonds.

Canada has CPI at 8:30 AM ET (YoY 2.1%, MoM -0.1%). The US has the Kansas City Fed Manufacturing Activity Index at 11;00 AM ET- typically not a market mover (est 6 vs 4 last month). Fed Tarullo is scheduled to speak at 9:30 AM ET. BOE’s Miles speaks at 2:45 PM.