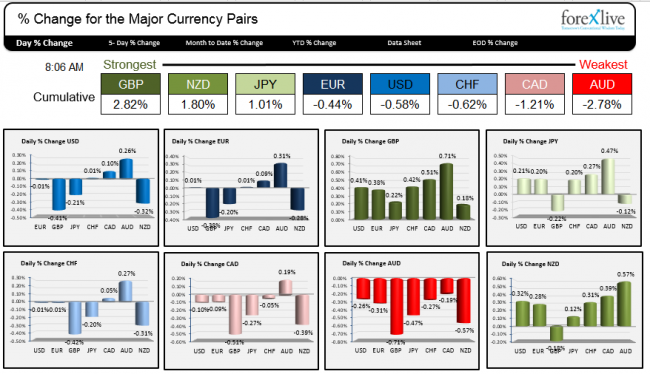

Although it is the day before Thanksgiving and traders will be making a hasty run for the exits, there still is a boat load of economic releases today in the US. The data has the potential to shift the bias around for some of the currencies. A snapshot of the currencies at the moment shows that the GBP is the strongest against it’s peers while the AUD is the weakest.

The strongest and weakest currencies as NY traders enter for the day.

In the UK the GDP data came out as expected 0.7%, however it was enough to push the GBPUSD above what has been a pretty strong ceiling a the 1.57344 level. The price of the pair has peaked at this level in 3 of the last 7 prior trading days. Earlier in the day, at the lows for the day, the pair found dip buyers against the 100 and 200 hour MAs. Currently, the price is testing the low from November 7th with the 38.2% of the move down from the October 28th high at the 1.5815 as the next target on a break. With the break of such a strong ceiling, traders who are long, would not want to see a move back below the 1.5734 line in the sand. The midpoint of the days trading range is at 1.5733 as well. So this area is important for the bulls.

The weakest currency today is the AUD. The AUD was hurt yesterday by comments from RBA Deputy Governor Lowe who said the currency should weaken more due to the decline in the terms of trade. Against the USD, the pair pushed farther away from the 50% midpoint of the move up from the 2008 low to the 2011 high at the 0.85423 level but found support buyers against a lower trend line on the hourly chart at the 0.8477 level (the low came in at 0.8479). This trend line (it is moving lower and is at 0.8472) will be eyed as support in trading today. On the topside the pair is currently testing the low from yesterday at the 0.8513 level. A move above would take some of the bearishness away with the 0.8528 and the key 0.8542 level (50% of the longer term move) as other levels to breach to get out of the bearish woods.

The support trend line held, with hurdles above looming now.

The Economic Calendar will create additional risk as does the holiday trading conditions.

– Durable Goods Orders are expected to fall by -0.6% vs -1.1% decline last month. The Ex Transportation is expected to rise by +0.5% vs -0.1% decline in September. Cap goods orders Non Defense ex air and Shipments of the same name are expected to rise by 1.0% and 0.5% respectively.

– Jobless Claims are estimated to dip slightly to 288K from 291K.

– Personal Income is forecast to rise by 0.4% in October vs. 0.2% last month. Soending is expected to rise by 0.3%.

– PCE Deflator is expected to remain unchanged in October. YoY is also expected to remain as is at +1.4% YoY.

– Chicago PMI is estimated to decline to 63.0 from the surpise 66.2 last month (highest since March 2011). This will be released at 9:45 AM

– Univ of Michigan confidence final is expected to rise to 90.0 from 89.4 helped by stronger stocks

– Pending Home Sales for October (+0.5%) and New Home Sales (471K annualized vs. 467K last monnth) complete a very busy economic calendar day.