GBP/USD lost around 30 pips from 1.5713 after the second UK GDP numbers for the third quarter. There was good news and bad news within the report but looking at growth from a wider perspective, the UK is still in a fairly good place, especially compared to the neighbours across the channel.

The fall investment is perhaps the biggest worry as if confidence is falling that can translate into a slide in hiring which will obviously hit the jobs numbers. We’re probably not going to see any effects like that ,given the time of year, when hiring is usually strong into the Christmas period. We’ll need to monitor if from around February onwards.

No one should be expecting the good times to come rolling around anytime soon and for us to be swimming in growth. All components of the economy still remain fragile.

If we see out Q4 on at least a level par to Q3, then that will mark a decent year for the UK ,considering where we’ve come from. It will also be a decent platform to build from next year.

For the pound, there’s nothing really in the numbers to see a big move either way. The BOE will stay on their current course and will hope that things pick up in Europe to give us a second wind.

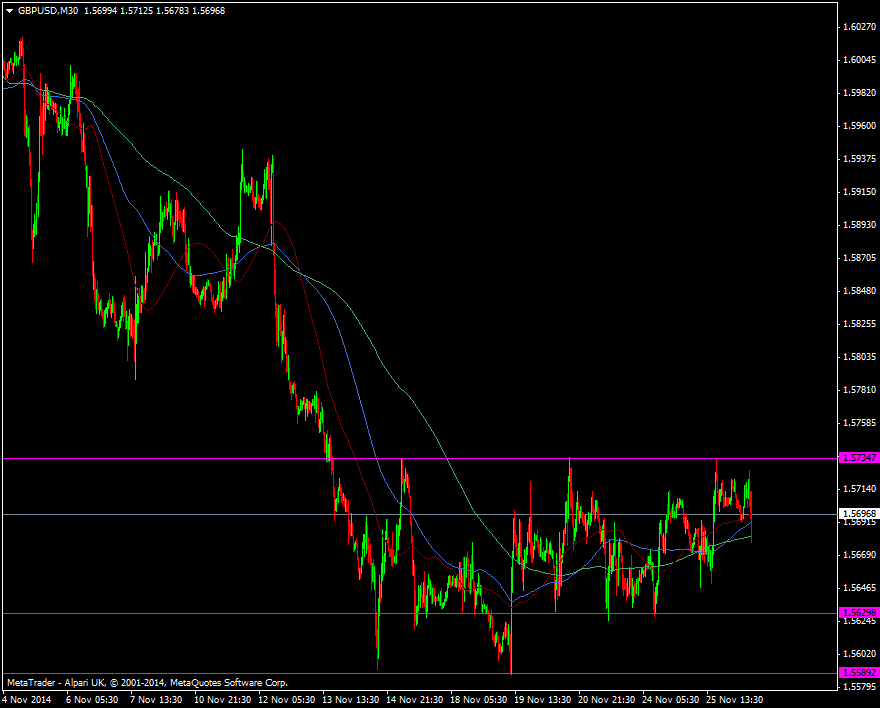

In the here and now for cable, we’re still in well defined ranges.

GBP/USD M30 chart 26 11 2014