Eurozone unemployment is unlikely to send the euro soaring 300 pips so inflation is the big number today.

The consensus is for a tick down to 0.3% y/y in the headline and an unchanged 0.7% in the core.

Given the German numbers yesterday,and the fact that oil prices have been on a one way street down, there’s little chance of seeing inflation rise today. The headline figure so close to the dreaded deflation disinflation line is bad enough in itself but the core number becomes more relevant while we have these energy price moves as it gives a better domestic picture.

The market is anticipating QE, at some point but we we still have no idea what it will be, whether sovereign, corp or any other fancy plan. A worse than expected number today is going to ratchet up the heat for next week’s ECB meeting.

The market is probably expecting a number on or close to 0.3% but if we get 0.1% or 0.0% that’s possibly going to hit the euro fairly hard and if the core falls too. If the core slips to 0.5% or lower that will add to the move. Even if inflation holds up or surprisingly rises then any gains in the euro are unlikely to last as that won’t be Europe out of the woods but probably a short stay of execution.

This is one of the last main pieces in the puzzle before next week and will go a long way in shaping the meeting.

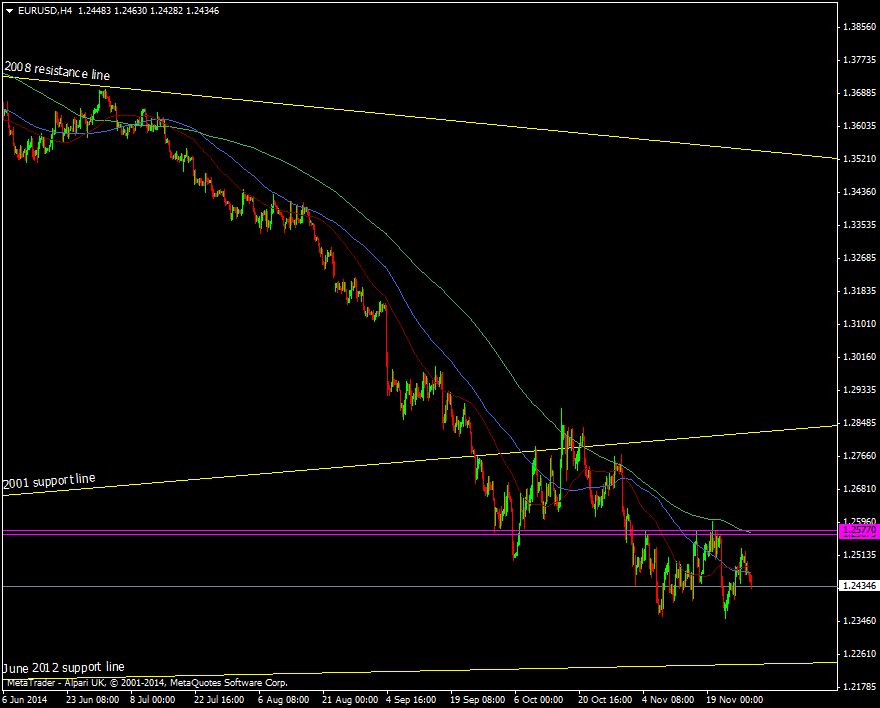

For prices, the big target below is the short term double bottom around 1.2450/55 and above 1.2575/80

EUR/USD H4 chart 28 11 2014