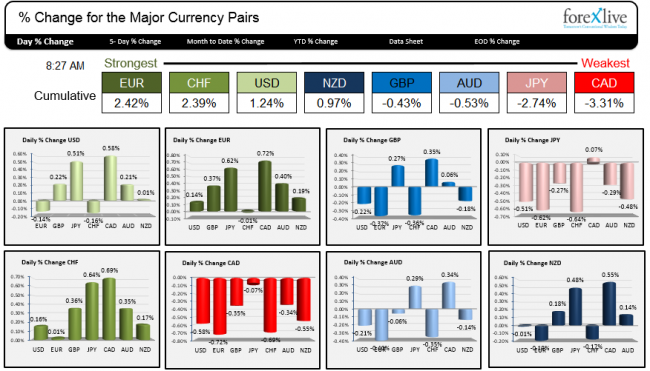

As NY traders (or some of them) return from the Thanksgiving day holiday, they face a EUR which is the strongest currency among the major currencies and the CAD which is the weakest.

The strongest and weakest currencies today (snapshot)

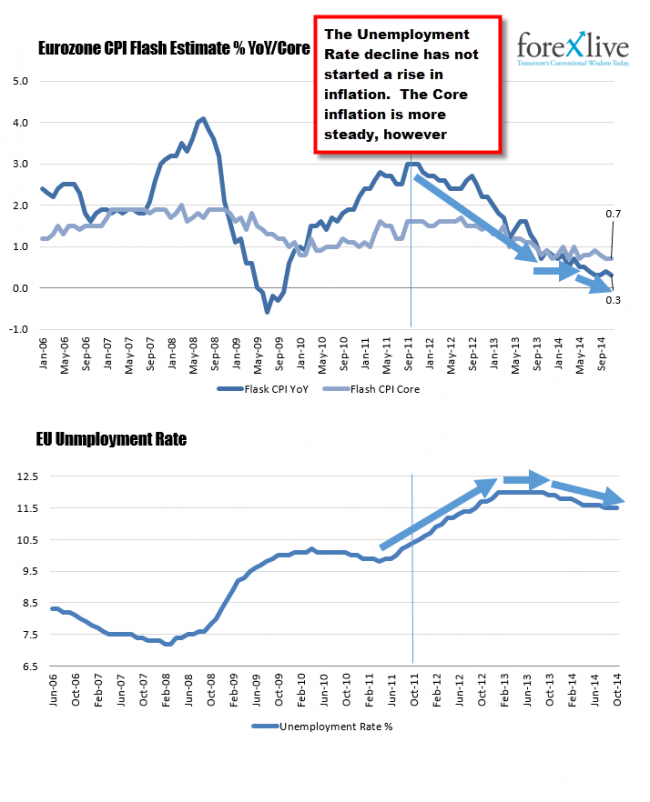

The Euro area released CPI Estimate and the Unemployment rate. The unemployment rate remained steady at 11.5%. The CPI Estimate fell to 0.3% from o.4% last month (it was as expected). The below graph shows the trends in each. The YoY inflation is at the year lows and lowest level since October 2009. The Core measure of inflation has stabilized between 0.7% and 0.8% since May 2014 (with one month that moved up to 0.9%). Meanwhile, the unemployment rate is steady at 11.5-11.6% since April 2014. The employment rate peaked at 12% from January 2013 to September 2013.

EU CPI Estimates and Employment Rate.

The fall in the unemployment rate has helped to stabilize the Core inflation rate. The headline inflation rate continued to move lower.

Despite the weakish trends the Euro is still higher – continuing the dip buying mentality.

Looking at the EURUSD, the pair was lower earlier in the day but has since rebounded toward the midpoint of the month’s trading range at the 1.24798 level. The 200 hour MA is flat-lining at the 1.2481 area. The move higher pushed the price back above the 100 hour MA (blue line) at the 1.24628 level currently. The pair is trying to see if the 1.2479 area can now be support and cause a run up to the 1.2500-08 area (lots of highs and lows in November trading) . If the momentum can not be sustained, look for a test of the 100 hour MA.

The EURUSD is trading around the 50% of the months range and the 200 hour MA

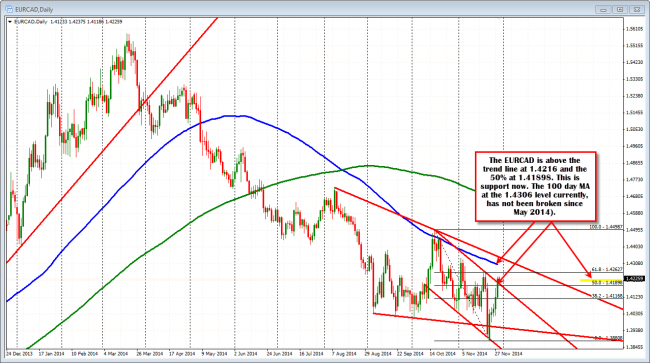

The weakest currency in trading today is the CAD. OPEC keeping production steady, has sent oil prices down and the Pavlovian reaction is to sell the CAD. The CAD is weakest against the EUR. Looking at the daily chart, the price has moved back above the 50% of the move down from the October high at the 1.41898 (risk for longs now). The trend line comes in at 1.4216 and this too might be a support level for the buyers. The 100 day MA (currently at 1.4306) 1.4306 above will be a key test if the momentum can continue. In October, that MA line was tested but the price could not close above the level. There has not been a close above the 100 day MA since May 7, 2014.

EURCAD is moving above trend line resista

.