Prior to the RBA interest rate decision later at 10:30 PM ET/3:30 GMT, and a slew of economic data this week including 3Q GDP, Retail Sales, and Trade data,the AUDUSD is up testing and now pushing above the 100 hour MA at the 0.85421 level (blue line in the chart below). The pair has been bouncing against this level over the last 4-5 hours of trading and is now trying to see if the current bar can close above the key technical level.

AUDUSD is extending above the 100 hour MA (blue line) at the 0.8521 level.

What helped give the bulls the technical trading edge today, came from what happened at the lows for the day. After PMI in China failed to impress over the weekend, the AUDUSD gapped and moved lower on the opening. The low for the day not only set new year lows, but also made new 4 year lows for the pair (lowest level since July 4th 20o7 week).

However, at the low on the hourly chart, the price tested lower trend line support (see blue circle 4 in the chart above). Holding the level was enough to turn the sellers into buyers, and the price has wandered higher since that time.

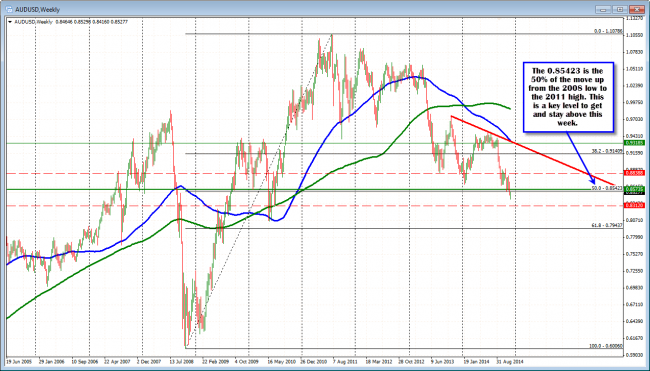

If the pair is able to get and stay above the 100 hour MA, traders will next eye the 0.85426 level. This is the 50% retracement of the move up from the 2008 low to the 2011 high (see weekly chart below). If the price is showing bottoming tendencies, a move to and through this level will be eyed by traders this week. However, I would expect that any test today (before the RBA) will likely find sellers. The event risk makes me cautious against that level, and I would expect the same from the market.

What can be expected from the RBA?

Needless to say the risk is increased going into the interest rate decision today. The RBA is expected to keep rates unchanged although Eamonn Sheridan in his post from earlier today, points out that there may be pressure to ease further down the road on the back of Iron Ore price decline and it’s impact on exports (see Pressure on the RBA for a rate-cut builds as iron ore price falls ). If a more dovish RBA statement is released, the rally today should reverse course. This event risk should help to keep on a lid on the upside trading before the announcement.

After the news is out, if the initial reaction is lower, traders will likely use the 0.8479 low from last week as a risk/bias defining level. If the price is able to hold this level on a dip, a further corrective move higher might be expected. A move below this level, however, will once again target the low trend line on the hourly chart. Will the 5th point on the line, be the one that breaks the support?

If the price does go higher, a move above the 50% level at the 0.8542 level should solicit more buying. Traders will want to see any break of this key level, to lead to more momentum and the price then becoming a new support level for the pair.

.

AUDUSD has the 0.65423 as the 50% of the move up from the 2008 low to the 2011 high.