The latest in our series of previews looks at the UK Autumn Statement to be delivered at 12.30 today by fin min George Osborne

It’s the second in the two most important UK government’s economic statements of the year after the Budget in spring.

Much of the content has been dribbled out since the week-end as Osborne attempts to show that he will keep investing in infrastructure but admitting that he is still having trouble keeping the budget deficit under control.

On Sunday he confirmed a £2 bln spend on the NHS and this week has seen further announcements on road building (including yet another tunnel-by-Stonehenge plan to help rubber-necking affected traffic-flow), flood defences and investment for SMEs

It appears that if he can’t give any money away to buy votes for next year’s general election he is at least trying to show the populace that he and his govt are still trying to get the job done, but he’s a long, long, way from wiping out the GBP 100bln deficit as he promised in 2010 when taking office

Coalition partner Lib Dem Treasury Chief Secretary Danny Alexander says

There will be further work to be done on completing the job, finishing the job of eliminating the structural deficit. That will be several tens of billions of pounds more.

But in the context of what we have done so far this Parliament, it is a further effort but it is a smallish – it’s maybe another third or so, a quarter, of that effort that needs to be carried on in the years up to 2017/18 which is when we have said we want to eliminate the structural deficit by.

We have to stay that course. To deviate from it would be to undermine one of the foundations of the economic recovery that we have been seeing.

But the plan to cut the UK’s budget deficit has been shattered by the revelation that the government will have to borrow as much as £75 bln more than it had originally planned over the next five years.

A fiscal forecast from the Office of Budget Responsibility (OBR) is due to reveal that the UK’s economic outlook is much bleaker than the government has let on. The coalition aimed to reduce the deficit in 2015 to £40 bln, but the latest figures show that it will actually be almost £100 bln

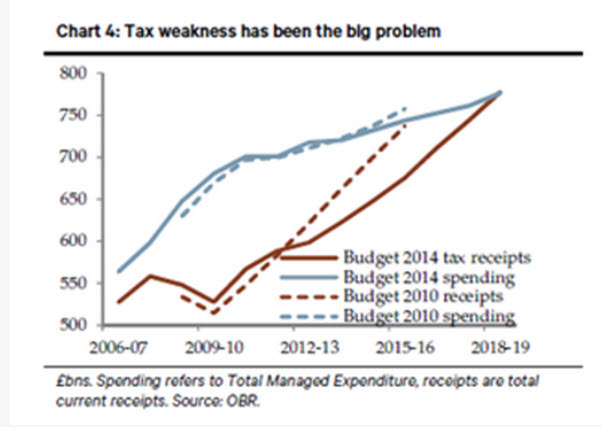

The bottom line is that the rise in employment levels has not produced more money into the the government’s finances given that many of the jobs are shared and real wage growth remains a concern hence less than hoped for income tax being received.

Also plenty of corporate and personal tax avoidance/efficiency going on out there so it’s more austerity in the pipeline for a while yet with the blame no doubt being thrown across the English Channel and elsewhere including falling oil prices

UK tax income to spending comparisons

Expect few surprises today and plenty of election-focussed politicking, but overall it won’t present the UK in the state of health that many expected by this time.

The Independent has a nice at-a-glance guide here and the Beeb carries this

Soon after today’s Statement the Office for Budget Responsibility (OBR) publishes its own estimates and forecasts and is expected to revise up its UK deficit forecast but also its growth forecast to 3% in 2014, from a March projection of 2.7%.

This would match the expansion in 2006 and cement Britain’s status as the fastest growing economy in the G7 this year. The OBR is expected to forecast growth of 2.6% in 2015, from a March forecast of 2.3%, while growth in 2016 is forecast to remain unchanged at 2.6%.

We can expect Osborne to make the most of any good news and forecasts to disguise the deficit issue that will rage more and more as next year’s election looms

Watch it live here ( if you’ve really got nothing better to do )

Osborne – Finding out that reducing deficits is not a precise science