Forex news for December 8, 2014:

- Fed’s Lockhart urges patience on liftoff

- Lockhart: Not in a rush to drop ‘considerable time’ phrase from the statement

- Fed’s Williams: mid-2015 is a ‘reasonable guess’ for lift-off – MNI

- November 2014 Canadian housing starts 195.6k vs 195.0k exp

- Canada Building Permits rise +0.7%. Lower than estimate of +3.9%

- Fed’s labor market conditions index 2.9 vs 3.9 prior

- Banks don’t want your cash, especially euros

- Eurogroup and Greece agreed on 2-month bailout extension

- Chatter about a Greek election

- BOE’s Weale: Have to look past oil on inflation

- ECB’s Nowotny Says QE Could Be ‘Useful’

- Gold up $12 to $1204

- WTI crude down $2.76 to $63.08

- US 10-year yields down 5 bps to 2.26%

- S&P 500 down 15 points to 2058 — largest drop since Oct 22

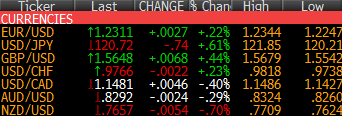

- JPY leads, NZD lags

The US dollar rally took a break on Monday, especially against the yen. Japanese economic weakness is bad news for the yen — but only to a point. If Abenomics doesn’t work then what’s next for Japan? It’s almost scary to contemplate.

The stock market also took a break and that pulled down USD/JPY to 120.21 before a late bounce to 120.70. Falling bond yields also weighed.

The comments from Lockhart probably didn’t get the attention they deserved but he raised the prospect of leaving ‘considerable time’ in the Dec 16 statement and that’s a dovish development.

EUR/USD hit a long-term low of 1.2247 in early US trading but was on a steady climb afterward up to 1.2344 before settling back at 1.2311.

Cable was on a similar recovery path as it climbed up to 1.5679 from 1.5542 in early Europe. It stalled for a period below 1.5650 but eventually broke higher. Late in the day, it’s pared back to 1.5642.

The Canadian dollar was surprisingly resilient given the bloodbath in Canadian oil stocks (down around 6%). Offers ahead of 1.15 are clearly holding back the loonie but the close at around 1.1480 will be a long-term high.