Preview of the quarterly SNB monetary policy meeting due 11 December 2014

The SNB doesn’t do hectic. Instead of monthly meetings where everyone flaps around guessing what’s going to happen we only get to flap around four times a year. It’s much more sedate. Take heed when the ECB switch to 6-weekly meetings

Last time the market got itself a little worked up over expecting a move to negative rates from the SNB. It didn’t happen yet the warnings were put in place.

“The economic outlook has deteriorated”

They said in September

Back then GDP was zero on the quarter and only +0.6% vs 1.6% exp y/y, down from a upward revised 2.5%

Last week GDP came in at 0.6% vs 0.3% expected q/q and 1.9% vs 1.4% expected y/y

“The risk of deflation has increased again”

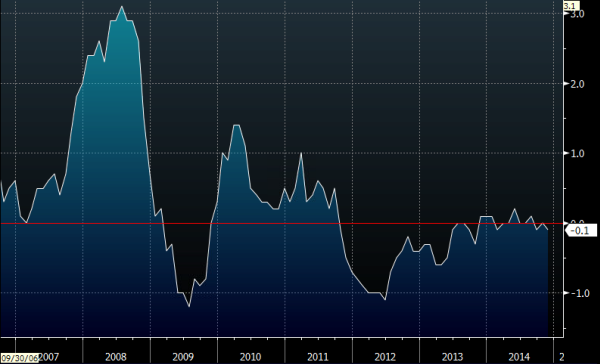

CPI in September was 0.1% y/y and has been down 0.1% in Oct, flat in Nov and -0.1% as of Monday.

Swiss CPI y/y

The core currently fares two pips better off at +0.1% y/y. With the fall in oil prices the core number is key going forward.

The rest of the economic data has been a rollercoaster in imports and exports, manufacturing, retail sales and the Zew survey.

Between September and here there’s not a lot from the Swiss side that would have the SNB changing policy.

And that’s where the real problem lies. The main risk isn’t from the Swiss side now (though there are plenty still) but from the European side and what the ECB does.

The SNB is in a situation where they may need to change policy to protect themselves from ECB action. If the threat of QE rises, or actually happens, then there’s going to be a lot of pressure put on the franc cap and Switzerland.

Inflation is obviously the buzz word for Swiss policy but even with it walking the zero line I think the SNB would rather keep their powder dry until the ECB makes a move. Inflation is low but it has been lower and they didn’t make a move when it was. They will want to see real signs of prolonged negative inflation to get them to move, and more than just pressure from energy prices. If they do move to negative rates it could well be that they’ve had a heads up from the ECB and are preempting any fall out.

That’s a long shot though and despite EUR/CHF getting a little bid on ahead of the decision, I think if anyone is expecting anything other than unchanged they are going to be disappointed.

Dare I say it but if we get a move up to the 1.2040’s or more on expectation ahead of the decision then a short might be the trade to play into it. That said, USD/CHF and the other crosses aren’t playing the game so I think real trading opportunities are limited. The best outcome we can hope for is a change in policy otherwise the can will be kicked into Q1 2015 when things will be clearer with the ECB.

We know the SNB has the balls to make a move but this quarter they’ll be using them for something else

Swiss balls. Made of strong stuff