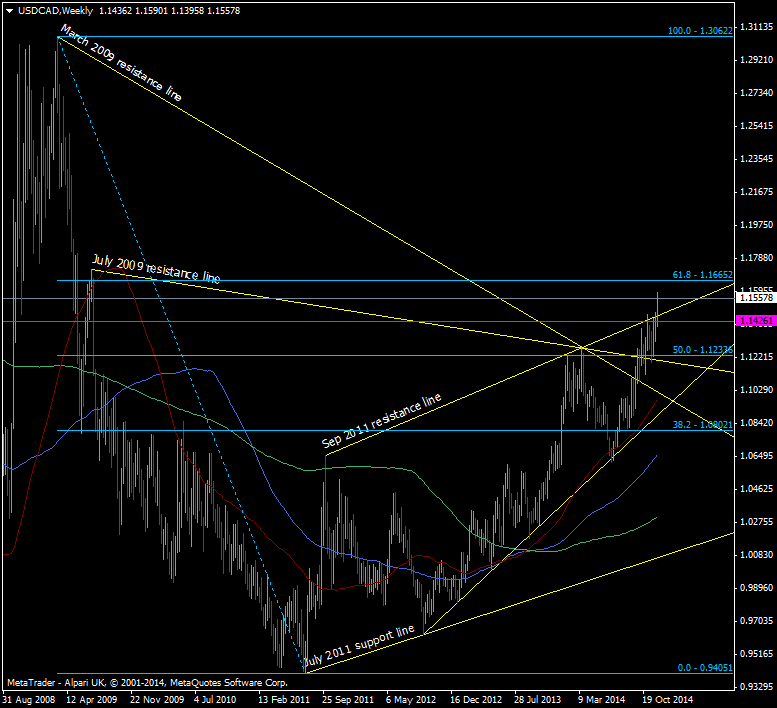

USD/CAD topped out just shy of 1.1600 earlier and slipped to 1.1534 before bouncing back to 1.1558. The move comes as WTI spills further to 58.79 in Feb futures.

USD/CAD Weekly chart 12 12 2014

The big level to watch is the 61.8 fib we’ve been pointing out recently at 1.1665, and below, the short term support is coming in around the 1.1530 and 1.1510/15 areas

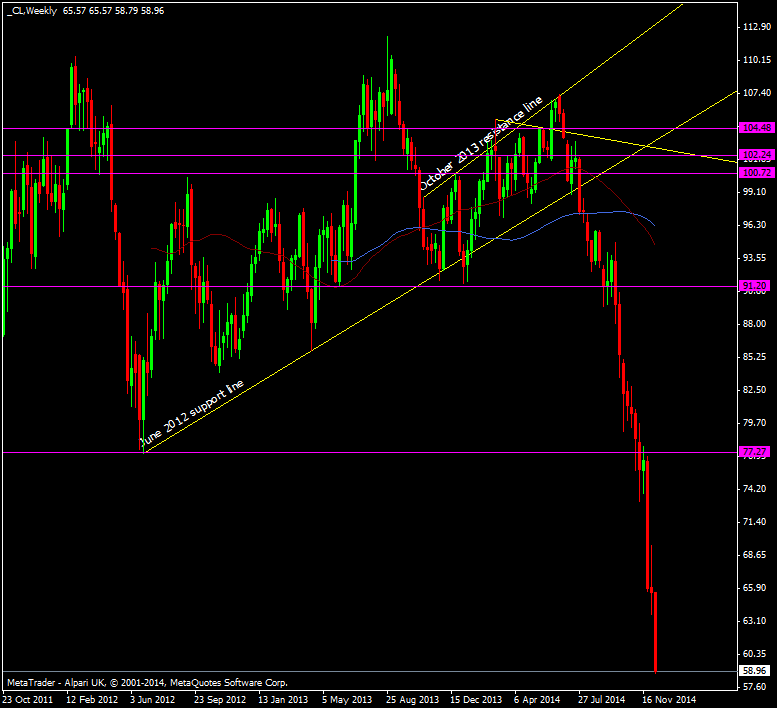

Oil is really starting to look ugly but the speed and severity of the drop is becoming scary.

WTI crude oil 12 12 2014

I’m getting the same feeling in my water that I did the other day when USD/JPY crapped out 250 pips. I’m not saying it’s going to happen now but the move is very fast, very hard and the further it goes the more violent any bounce will be. With oil that can be 5-10 bucks in moments. If you’re short and loving it then it might be time to start setting some trailing stop levels in anticipation of a bounce. Carry on nursing it down by all means but don’t let those profits shrink on a short term correction.