Preview of the Bank of England’s MPC minutes from the December 2014 monetary policy meeting and UK labour market report due 17 December 2014

Ahead of the Fed the little old UK spills the beans on monetary policy positioning and jobs.

The two MPC hawks, Martin Weale and Ian McCafferty look to be spending the holidays alone in the cold while the rest stay perched in the warm on the other side of the vote fence. That will keep the vote at 7/2 on maintaining rates at current levels.

“Can’t we vote for unchanged and try again in the spring when it’s warmer Ian?”

The details of the minutes will no doubt mention inflation, lower oil prices, and as we heard from Carney and Cunliffe, possible headwinds arising from domestic risks. The market will shrug those risks off, particularly any mention of housing risks as we’ve already seen the new BOE rules having an effect with falling prices, and now the new government rules on stamp duty will be kicking in. Try as they might the MPC are running out of dovish excuses.

The economic data has picked up into the last months of the year. Nothing amazing but enough to stop the slowdown we’ve seen from the end of summer. I’m not expecting much from the minutes but there might be some bullish words for the UK economy for when we enter 2015

And speaking of data, we get the latest round of jobs numbers (for November) as well as the all important wage data for October.

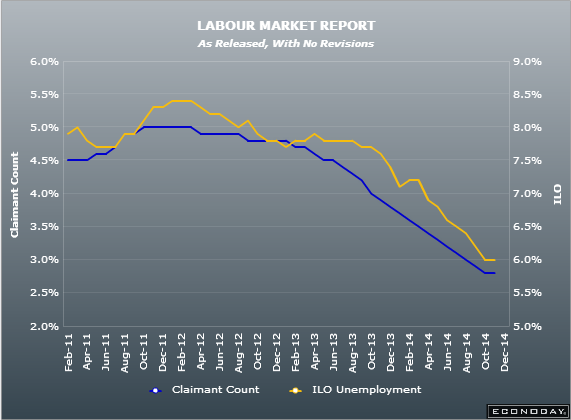

The claimant count is expected in at -20k vs -20.4k prior with October’s unemployment rate forecast to tick down to 5.9% from 6.0%

UK labour market

Wages are expected to rise 1.2% vs 1.0% prior y/y (ex-bonuses 1.5% vs 1.3% prior)

The data is a bit lagging so if there’s a sign that jobs have suffered in the recent downturn, it’s more than likely going to show up in this read. If it doesn’t then the jobs market will continue to look very rosy going into 2015. One thing we could see is some effects from seasonal hiring, so bear that in mind if we get a really strong number.

For wages, we saw a two tick improvement last time out and we’ll want to see that continue or last month might be consigned as a one off. The public sector pushed pay higher in September but we need to see broad based wage rises before getting excited that pay is trending up.

UK labour market report wages

Trading wise, the minutes are likely to be a dud but keep an eye out for any positive comments for the year end and last quarter. As I mentioned above, the BOE are running out of dove potion and that means the pound is only going one way. Any knock down for the quid on the minutes will likely be soaked up. For jobs, I still think the risk is of a lower number than expected and again, that might give the dip buyers another opportunity. However, any falls in jobs will be countered by another decent jump in wages.

As usual we’ll have the numbers and the details as soon as they hit the scoreboard