Forex news for December 18, 2014:

- December 2014 Philly Fed business index 24.5 vs 27.0 exp

- US initial jobless claims 289k vs 295k exp

- December 2014 US Markit services PMI flash 53.6 vs 56.9 exp

- US November leading index +0.6% vs +0.5% expected

- Obama signs latest Russian sanctions bill into law

- Italian PM Renzi says “absolutely no” to new sanctions against Russia

- Low rates can encourage banks to reach for yields says Yellen

- US sells 5-year TIPS at 0.395% vs 0.398% WI

- Gold up $7.50 to $1197

- WTI crude down $1.64 to $54.81

- US 10-year yields up 7 bps to 2.21%

- S&P 500 up 46 points to 2060

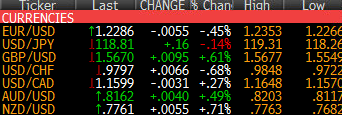

- GBP leads, CHF lags

The stock market is absolutely sizzling even with oil taking another dive. The two-day rally in the S&P 500 was the largest since 2011 in an awe-inspiring comeback after 7 days of losses . Today’s rally was the largest since January 2013.

For all the excitement in stocks, the FX market was a but more skeptical. USD/JPY took out 119.00 in the early going but later faded back down to 118.58 before settling at 118.83.

The euro broke to a session low at 1.2266 at the same time but it was a similar story with the fresh low short lived and a bounce to 1.2298 and the a flatline at 1.2285.

Cable came into US trading at about the same levels it finished at, near 1.5665. It dipped in the early going as the glow from soft retail sales faded and the pair hit 1.5603 but a later wave of excitement pumped the pair up to 1.5670.

For all the pain in the oil market, once again, USD/CAD actually fell 30 pips on the day to 1.1600. A pair of rallies to 1.1630 faded and then it slide to 1.1587 before a small bounce.

In another sign that excitement was limited to stocks, the Aussie dollar lost ground down to 0.8146 compared to 0.8200 near the start of US trading. Some heavily sellers lined up at that big figure.

Oil took a run at $59 for the second day in a row and fell short of yesterday’s high. That was the signal for sellers as it plunged down to $54.52 in a nearly 7% intraday plunge. What’s left to say about oil?

FX ticker

Just one of those days that no matter how long you are of stocks, you wish you were longer.

Or there’s this, from twitter: “Dow up 400 points as nation narrowly avoids new Seth Rogen movie”