The BOJ at the conclusion of their meeting.

- Keeps monetary policy steady, pledges to increase monetary base at annual pace of 80 trln yen

- Decision was made by 8-1 vote

- Kiuchi votes against keeping policy steady, saying that policy before the October 31 easing was appropriate … also proposed making 2 pct inflation target a medium- to long-term goal, which was turned down by 8-1 vote

- The BOJ raises its economic assessment

- Raises assessment on output

- Raises assessment on exports

- Says the Japanese economy continues to recover moderately as a trend with effect of sales tax hike waning as a whole

- Says that exports are showing signs of pickup, output seems to be bottoming out

- Business sentiment generally favourable although some cautiousness has been observed

- Capex has been on a moderate rising trend as corporate profits improve

- Private consumption remains resilient as a trend with effect of sales tax hike waning as a whole

Headlines via Reuters

Added:

- BOJ says the core CPI is likely to be around the current level for the time being

–

Well, you can’t say these guys and gals at the BOJ aren’t optimistic … raising their economic assessments. I hope they are right for Japan’s sake.

–

Here is the full text: Statement on Monetary Policy (Announced at 12:28 p.m.) [PDF 149KB]

–

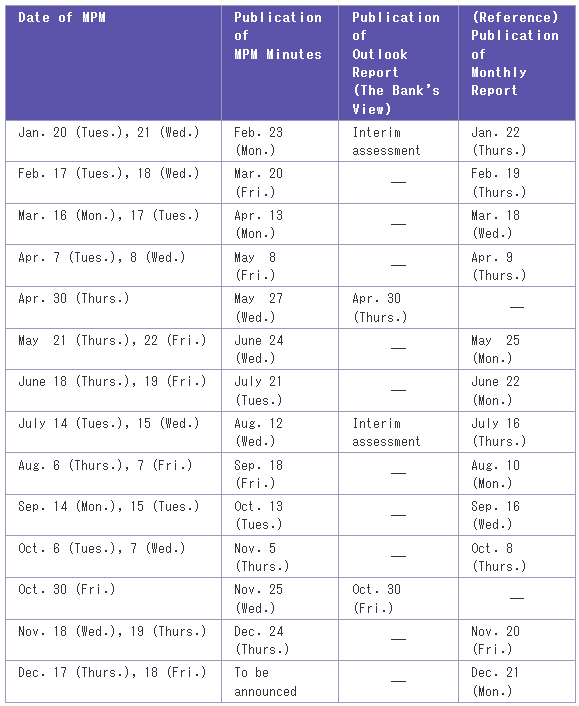

Oh … and let’s take a look ahead … Scheduled Dates of Monetary Policy Meetings in January-December 2015