Forex futures market speculative positioning data from the CFTC Commitments of Traders report as of the close on Tuesday Dec 16, 2014:

- EUR net short 126K vs short 137K prior

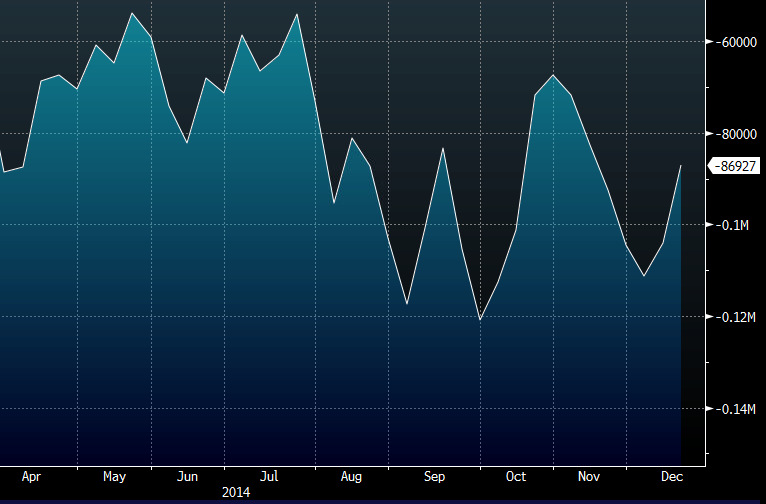

- JPY net short 87K vs 104K short prior

- GBP net short 34K vs short 35K prior

- AUD net short 34K vs short 45K prior

- CAD net short 16K vs short 14K prior

- CHF net short 3K vs short 22K prior

- NZD net short 1k vs short 2k prior

This is an embarrassing report for the specs. They bailed on USD longs right before the FOMC meeting and bailed on a substantial short CHF position before yesterday’s SNB moves.

Yen shorts are at the same level as in July — the market has been on the right side, but for such an amazing trade, it’s not at all crowded.

Yen net short

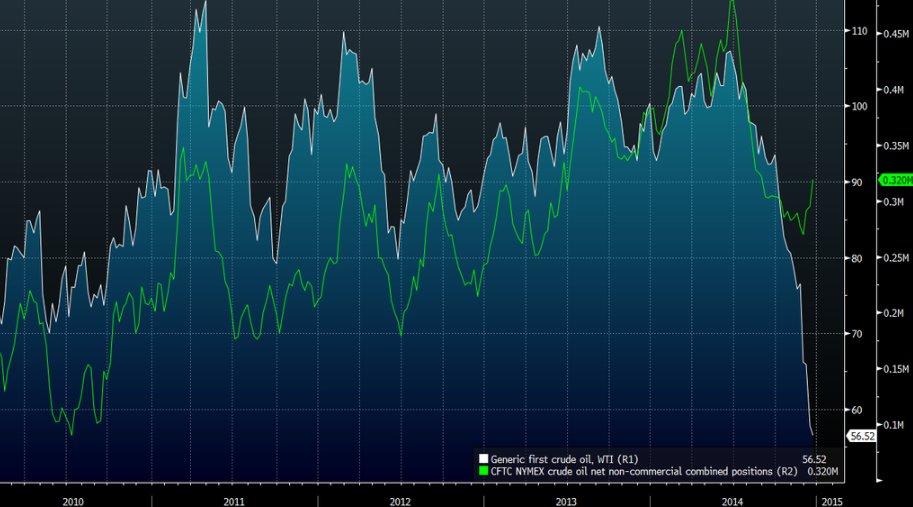

Oil longs also tried to catch the falling knife.

Oil CFTC via @boes