Forex news for January 21, 2015:

- Bank of Canada cuts rates to 0.75% from 1.00% in surprise move

- BOC severely downgrades 2015 forecasts

- Full text of the Bank of Canada decision

- Poloz says BOC has ability to “take out more insurance” in press conference

- ECB said to propose QE of 50 billion euros per month through 2016

- December 2014 US housing starts 1.089m vs 1.040m exp m/m

- OPEC Sec Gen says oil has overshot fundamentals

- Canadian Nov wholesale trade sales -0.3% m/m vs 0.0% m/m exp

- ECB hasn’t made any decisions yet says Merkel

- Swiss government repeats their trust in SNB’s Jordan

- Chinese premier says economy will continue to feel downward pressure in 2015

- ECB said to approve emergency funding for Greece

- API weekly crude oil inventories +5.7m barrels

- Amex planning thousands of job cuts, Ebay too

- RBC to charge negative rates on euros

- FXCM raises forex margins, no word on negative balances

- Law firm launches investigation into FXCM

- German 10-year yields rise most in more than a year

- Gold down $1.55 to $1293

- WTI crude up 91-cents to $47.39

- S&P 500 up 9 points to 2032

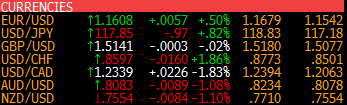

- CHF leads, CAD lags

The Canadian dollar fell the most in a day since 2011 on the shock decision from the Bank of Canada. USD/CAD instantly rose to 1.2270 from 1.2070 and then chopped in a a 1.2315-1.2270 range until the press conference. After Poloz began it continued higher and eventually hit 1.2394 although there wasn’t much market-moving in the presser. Late-day selling saw the pair slide back to 1.2330.

EUR/USD caught a huge bid early in USD trading after chopping around 1.1570 in Europe. It quickly raced to 1.1638 and was capped by yesterday’s high. The initial ECB headlines drove it back to 1.1570 but confusion reigned afterwards and a squeeze hit all the way up to 1.1680 with stops hitting above 1.1680 but there really wasn’t anything hawkish in the leaks and it skidded all the way back to 1.1570. Lately, however, it’s crawled back to 1.1615.

USD/JPY fell in Asia and chopped in a 50 pip range around 117.50 bottoming at 117.25 on some early US stock weakness and USD selling that bizarrely came after a solid housing starts report. A better turn in stocks helped a rebound all the way to 118.18.

GBP/USD slumped on the MPC minutes as the hawks threw in the towel. The bottom came quickly as buyers once again were there at 1.5080. It was really whippy from there in the 1.5080 to 1.5140 range with a few trips to either side. Lately, we’re back near the top at 1.5140. The topside is getting more enticing — if the market can’t selloff on dovish news, when can it?

AUD/USD bulls read the BOC news with dread and are thinking they’re next. AUD/USD fell hard down to 0.8080 from 0.8220. The range has been super-tight since the BOC decision. Note that 0.8045 and 0.8000 are some major levels (and that the RBA and BOC are different central banks).

To get ready for the day ahead with this ECB preview.

FX ticker